Do you know how much your credit utilization matters regarding your credit score? With so many factors influencing it, keeping track of everything that affects them is hard. It’s not a secret that both affect much more than just loan applications.

It can impact the interest rates you get, the insurance premiums you pay, and even whether or not you can rent or buy a property. Keeping your credit utilization in check is essential for maintaining a good score.

Here we will discuss the role of credit utilization and credit score and how to manage and maintain them.

What Exactly are Credit Score and Utilization?

A credit score is a significant factor that showcases someone’s financial health. It is something that exists in every country and affects everyone who owns a credit card. In its essence, this score represents creditworthiness in numbers.

It is calculated based on how you use your card and build credit by making various purchases. It tracks most spending and records their history and other factors (financial). Probably the most crucial aspect of this score is your credit utilization.

Useful Info: Credit represents a record of all money flowing out of your bank account, while debit is all cash inflows. If we have to explain it, credit utilization is the amount used compared to the available limit. The card issuer (bank, for example) sets the stated limitation.

Utilization measures how much of the said limit you are using at a point in time. Most often, the usage is showcased in percentage. Example: Let’s say that an individual has a card with a set limit of £10,000 and has used about £5,000. In this situation, their utilization would be precisely 50%.

At this point, many are probably wondering why this factor is so important. Well, let’s say it like this: you got a credit score to keep a good impression on all financial institutions, particularly lenders and banks.

So if this utilization is messed up, it will affect your score. Also, if your utilization percentage is high, it will alert the lenders or other institutions that you are often overextending your limits.

That’s why having high credit utilization means you are getting close to the limit. That will probably worry all potential lenders because it may indicate that you can often not make timely payments. The least it will show that you are bad at controlling budgets and spend more than needed.

What Is the Average Credit Utilization I Must Have?

That is a good question, as it plays a significant role in many situations. If we have to speak on average, most lenders and institutions in the UK prefer to see credit utilization at a rate of 30%.

But, it will be better if it’s lower and around 10-15%. For example, if someone has a card and its limit is again £10,000. The maximum they should aim to use is no more than £3,000 to keep up to the 30%.

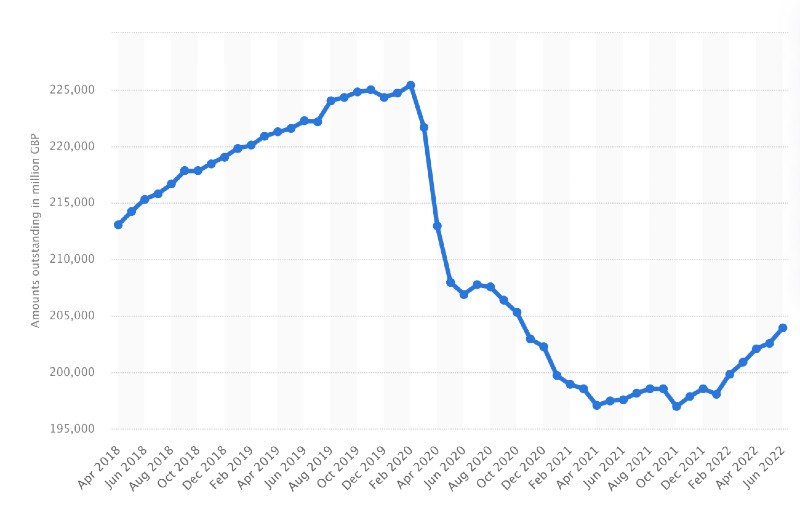

To bring an overview of the country’s outstanding consumer credit situation, based on statistics, it’s relatively high. Currently, it’s about 204 billion British pounds (excluding student loans). That showcases a massive increase from 2022 – around 198 billion. Despite this growth, the outstanding consumer credit remains lower than that for the year 2020.

As we said above, overusing the credits and having high utilization will decrease your score in many situations. That will make it hard to obtain any credits in the future. Tip: To use more money than you have, increase your limit, so you won’t have high utilization. That occurs by regular payments, which increase the trustworthiness, or by proving high income.

Best Tips for Managing Credit Utilization in the United Kingdom

At this point, you probably worry about the best way to manage the said credit utilization. But you don’t have to, as we have prepared fine pieces of advice that will allow you to do so. First, to maintain a good credit score and keep your credit utilization in check, you’ll have to follow these basic guidelines that will assist with managing it:

1. The foremost thing everyone has to do is monitor their credit utilization regularly. It is easy to check; you can do it by logging into your online account, using an app like Totally Money, or contacting whoever the card issuer is (bank/financial institution). Ask for a credit report, and you’ll get all the info needed. Doing this allows you to track your money outflow from your card and the credit you are using. This way, you’ll ensure you are not overextending.

2. Paying all bills on time is also crucial. Making late payments have a significant impact on the overall credit score. Thus, it’s vital to make sure you repay back. In addition, every dept paid on time will sustain the utilization and possibly improve your score.

3. Another thing everybody can try is to keep their card balances low. While it may sound weird, it will help and is a way to ensure that the utilization sticks below 30%. Through this, it’s easy to maintain a decent score and show potential lenders your budgeting abilities.

4. Next, the best tip will be to use many credit sources. Like nobody needs to limit themselves, so using multiple cards is a good idea. This way, everyone can spread their credit utilization over all the cards, which will help keep the total percentage low. A great example is to have multiple cards (2-3-4 or more), each for specific purposes only (traveling, groceries, bills), and this way, you’ll keep your utilization low.

5. When buying a mobile phone, go for a sim only contract no credit check.

Credit balances must never be held high. If you have them like that, you better pay them off soon. Doing so will reduce your overall utilization and possibly improve your score.

Our take

Ultimately, credit utilization is a primary factor affecting your score in the UK. So, what we have learned is that by:

- Keeping your card balances low;

- Paying all your installments on time;

- Checking the utilization percentage regularly;

- Using different cards for specific purposes;

- Paying down your balances.

With these, you can maintain a proper utilization percentage and score. Please note that these are important factors affecting your budget and financial health. Thus, it’s crucial to take all necessary steps to maintain them and enjoy your life carefree.