Zellar, a sustainability score for businesses, has received a £600,000 investment from The Co-operative Bank.

Headquartered in London, Zellar was founded to help SMEs measure, plan, activate, report and share their sustainability journey and reduce costs.

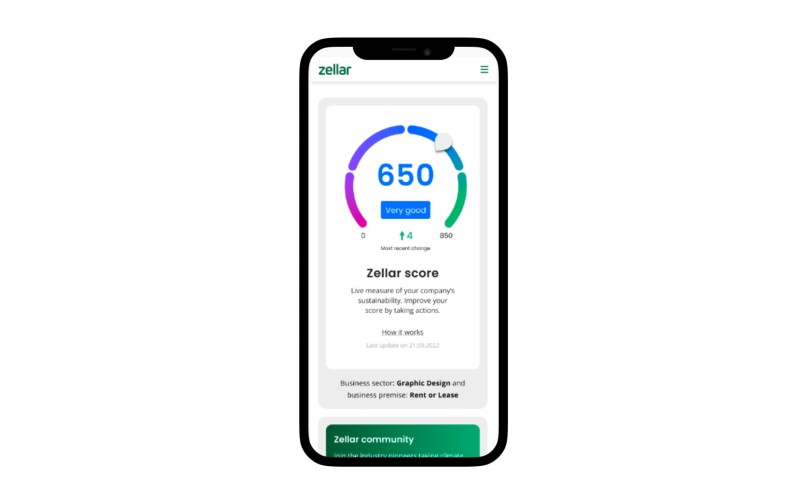

It captures every sustainable action that a business takes and reflects it all within a single score that shows both them and the outside world their sustainability progress.

The deal follows the successful roll-out of an initiative launched earlier this year, in which The Co-operative Bank pledged to provide lifetime subsidised access to Zellar for all of its UK-based SME customers.

The Co-operative Bank’s investment is in return for a 2% share of Zellar, based on a £33 million market valuation.

As part of the agreement The Co-operative Bank will continue to promote Zellar to its SME customer base. It will also work closely with the company to help develop products and services that reward and incentivise sustainable businesses – in line with Zellar’s scoring framework. The Co-operative Bank will also sit on Zellar’s steering committee.

Zellar plans to use the investment to support a number of platform developments already in flight. Zellar is currently focused on creating richer, deeper and more meaningful experiences within the platform, by heavily customising the sustainability journeys across an initial 64 business sectors.

“As the UK high street bank with the best ESG score from independent analysis, The Co-operative Bank is a perfect investor for Zellar,” said Gary Styles, founder and CEO.

“We hold so many shared values. We both believe passionately in cutting though the greenwash and driving meaningful environmental change, and helping local businesses and their wider communities to take action.

“The overwhelming interest shown by The Co-operative Bank’s customers following our launch programme in June this year, is a real confirmation of the synergies between our two companies.

“This investment will help us to deliver an even better, more meaningful experience to our shared customers and beyond.”

Zellar’s SME base is increasing rapidly through partnerships with The Co-operative Bank, SSE Energy Solutions and a growing number of local authorities.

“We also have a number of ground-breaking pilots underway with nationwide corporates – as well as institutions like school academies and faith institutions – all of whom have the shared challenge and responsibility of understanding and driving local sustainability across multiple UK sites,” added Styles.

Catherine Douglas, managing director at The Co-operative Bank, commented: “Zellar has become instrumental in helping us to deliver on our vision of igniting and driving action against climate change amongst SMEs.

“We’re delighted to be following up on the success of our subsidy programme by continuing to work with and invest in Zellar. This will not only help to enhance the experience for our SME customers on the Zellar platform, but for thousands of other businesses across the UK.”

The Co-operative Bank becomes the first external investor in Zellar and marks the opening of a seed investment round, in which the company is seeking a further £2.4m to further develop the product in 2023.

A bank with a difference: How Co-operative Bank is revolutionising its SME services