A challenger credit card company aiming to boost financial wellness has raised £5 million in seed funding.

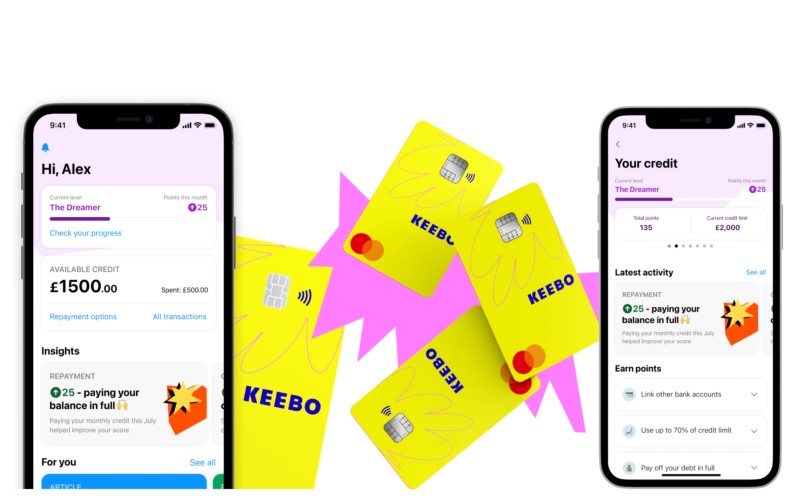

Keebo claims to be the only credit card company authorised by the FCA for open banking-based underwriting which looks into a customer’s broader financial behaviour and encourages financial wellbeing beyond simple debt repayments.

The FinTech startup has been awarded three technology grants from the UK government, totalling £425,000, and has now been backed by Breega (backers of Moneybox) and Connect Ventures (backers of Truelayer).

Every transaction made with a Keebo card – and all linked accounts – feeds into the company’s underwriting technology to give users a true understanding of how they are building towards their life goals on a daily basis.

It says it can then provide them with fair, low-interest credit, even if they don’t have a credit score.

Keebo, founded by Michael Vanaselja and Matthew Hallett, will launch in October this year.

“It is more important than ever that we change our relationship with money – to take the fear away from ‘healthy’ debt and bring a strong dose of wellness into our finances,” said CEO Vanaselja.

“By leveraging new technology never used before in a credit card, we are proud to have created an app designed to change the future of finance for the next generation. We are thrilled to have the support of incredible investors in bringing Keebo’s vision of personalised credit to life.”

Ben Marrel, co-founder and managing partner at Breega, commented: “Access to safe and affordable credit should not be biased, yet today we see this happening time and time again, driving many to approach options which can put their financial future at significant risk.

“The solution that Keebo offers and the methods and technology it uses provide a real solution to this issue. We’re truly delighted to be accompanying and supporting the team on this very new and exciting venture”.

Rory Stirling, partner at Connect Ventures, added: “Consumer credit is a fundamental and necessary part of our modern society. And yet, accessing consumer credit is broken for millions of people because they have no credit history, or because they’re negatively impacted by generic credit scoring that is outside of their control.

“We’re excited for Keebo to build a new category of ‘personalised credit’. We love the Keebo mission and have been blown away by what the team have been able to achieve in such a short space of time, including being the first to be regulated by the FCA for behavioural underwriting.”