Real estate is the world’s largest market, representing a third of the planet’s wealth and a third of global cashflow.

Our obsession with property also seems to define our lives: from renting a first flat or shared house to getting on the ladder, perhaps upsizing, then eyeing a dream home or holiday retreat.

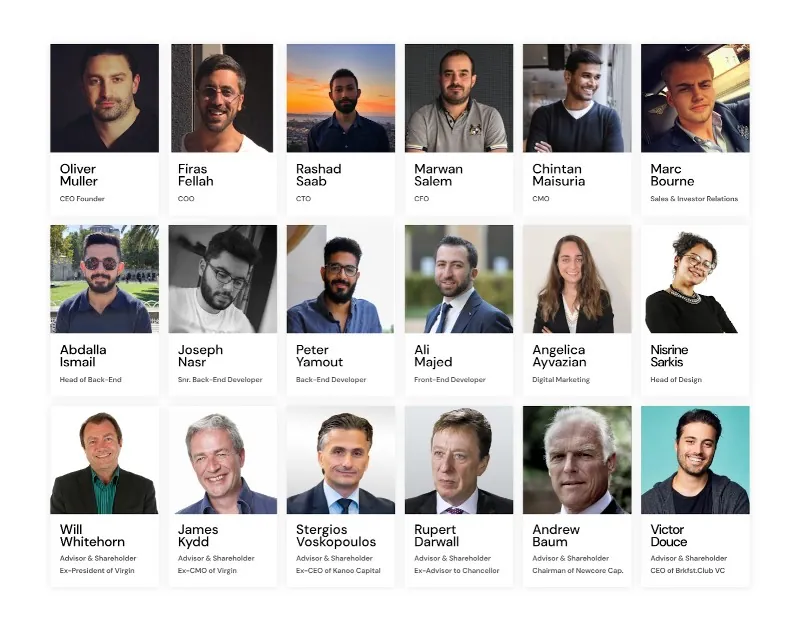

This may explain the enduring popularity of the board game Monopoly. “Monopoly was one of the first games I played when I was a kid,” Oliver Muller, CEO of PropTech 50 star PropertyCard, tells BusinessCloud. “I was very curious about this game, so I looked up the pattern, the economics behind it.

“In my childish way, I wanted to know: why is this the number one game on the planet? Why have a billion people played it? It opened up my eyes to something: acquisition of wealth happens in a very distinct way.

“There’s genius behind that game: how and when you can buy and trade and build the hotels and the houses – when you have a monopoly on a street – applies to how wealth is created in the real world.

“I wanted to build a real-life version of Monopoly.”

Bomb attack

Muller, who spent his childhood in war-torn Lebanon – a bomb even hit the hospital on the day he was born – is a former Dubai-based derivatives trader and property fund manager who noted that payments and services in this huge industry were scattered across multiple providers.

“The solution in this sector is to do it all. Look at the dominance of WeChat in China: the East loves its super-apps, with everything in one place, but the West is slower to adopt them,” he says.

“We want to build the largest property super-app that can be used by all one billion homes on Earth. There is a dire need for every homeowner and tenant to manage their properties in one central place, whether it be listing their homes for sale or rent; booking utilities; storing documents; or performing KYC (know-your-customer checks).

“The Monopoly card simply displays the price of the house, the rent and utilities. Those are the three words on the front of our PropertyCard – because they comprise 99% of the cashflows on every home on planet Earth. You can forget everything else.”

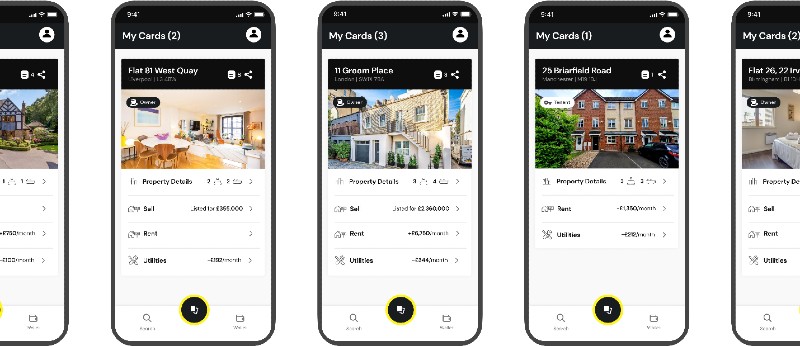

PropertyCard app

You can activate your home’s PropertyCard as a tenant or owner inside the app by scanning in documentation such as a title deed. Regulated by the Financial Conduct Authority in the UK, payments can be made through the app.

“Open banking has made all this possible: all the ingredients to build a category-leading business are now there,” says Muller. “The most important question now is: how do we get there?

“It took us many years to build the product because it had to be standardised globally from day one. [Online estate agent] Purplebricks saw incredible growth in the UK. One reason for its failure when it launched in the United States and elsewhere was its business is too capital-intensive: that makes it hard to open in a new country.

“By differentiation, PropertyCard costs almost zero to open in a new country – we built it with that in mind. The only cost is to plug in a couple of utility partners to get the data for address lists up to date. Then it’s just marketing: we don’t need offices; we don’t need sales forces on the ground; it’s all digital, remote and very lean.

“Our burn rate is around £25k a month. That’s nothing for what we have. A lot of money is being blown in PropTech before businesses have figured out how to operate, but we had our backs against the wall so we didn’t have a choice. I put most of my savings into this, so I had to do it right.”

Collaboration is key

The plan is to raise a £5 million seed round in the first quarter of 2023, says Muller, and to keep “chipping away” at potential partners.

“The industry is secretive – no one wants to work together. I’ve tried to work with everyone!” he says with some animation. “I came with open arms, open spirit, so we can plug and play and make money together – but they won’t have it. That’s not how they operate.

“I’ve had a hard time chipping away at people’s way of doing things and it’s slowly starting to work – but against their will. It’s caused us a lot of delay.”

If the building of PropertyCard has been delayed, the same could certainly be said of the moving process. Along with relationship break-ups and the loss of a loved one, moving house is frequently cited as one of life’s most stressful events.

A friend of mine and his family, for example, have literally moved into their new home today after six months of solicitor shenanigans which threatened to derail the whole chain at several points, causing unnecessary strain and anxiety.

“We want to make the property cycle go from 60 days, which is average now to sell a house or get a mortgage, to zero,” states Muller. “You should be able to buy a property with one click – that’s the future.

“You can buy a supercar today in one hour. Why can’t you buy a house at the same price in one hour? Why should it take two months? The solution to real estate is speeding it up. You’ll know we’re doing something right when the turnaround times go from 60 days to 50 to 40 to 30. When we head towards zero, you’ll know that we’re winning.”

Bigger than Google

The PropertyCard portal allows people to list their property for sale or rent and set a price.

“In the next year we’d like to make a name for ourselves in the UK so that people think of Rightmove, Zoopla, then PropertyCard. Two or three years after that, we’d like to give them a run for their money,” says Muller.

The headline for an interview with a determined entrepreneur might often signal a billion-pound ambition; but for Muller, the opportunity is in the realm of the trillions.

“I’m going to make a bold prediction here: a business doing what we’re doing – if not us, then someone else – will become the biggest business on the planet within 10 years. That’s No.1 – larger than Tesla, Google, all of them.

“The world’s wealth, all of it, is in property. Whoever centralises all of this stuff into one giant super-app and delivers on execution is a business with a T next to it, not a B.”

PropTech 50 – UK’s most innovative property technology creators for 2022