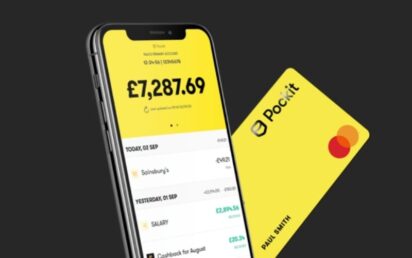

FinTech Pockit has launched a ‘Fast Track to Credit’ credit builder product.

London-based Pockit aims to provide vital financial services to people whose needs aren’t met by the traditional banking system.

The new service will help people locked out of the financial system quickly improve their credit scores, allowing Pockit’s customers a safe, regulated and sustainable route to access a wider range of financial services requiring a good credit score, such as loans, mobile telephone contract or car finance.

The product, offered to customers in Pockit’s top tier of subscription plans, gives customers a virtual loan which is created and held in savings, against which the customer pays a monthly sum to mirror a repayment scheme.

These repayments are reported to the three major UK credit agencies, Experian, TransUnion and Equifax, in order to assist customers in building their credit profiles quickly.

Missed subscription payments are not reported to credit agencies and will not harm credit scores. Should customers make back the payments as scheduled for three months, then they are offered a real loan between £50 and £300, repayment of which further helps improve their credit profile.

The launch of the credit builder product comes as UK consumers are squeezed by the twin pressures of cost-of-living increases and reduced availability of credit.

“We are motivated by looking after our customers and giving them a helping hand. Too many people are shut out of the financial system due to low credit scores, leaving them unable to access essential financial products like loans, car finance or telephone contracts,” said Virraj Jatania, CEO and founder of Pockit.

“We have listened to our customers who have said they want a little extra help in building their credit scores from a provider that they trust.

“Following successful testing, we’re delighted to be introducing the Fast Track to Credit plan to help support our customers develop a strong credit score in a way that is safe and reliable, empowering them to take more control over their financial journeys.”