A loss-making MedTech device company has agreed a deal for a bridging loan to be followed by £2.4 million of equity funding.

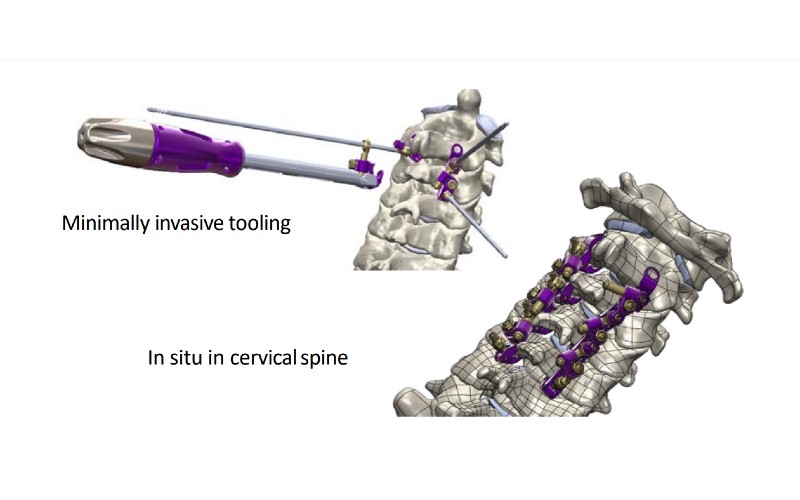

Gatwick-based TruSpine Technologies Plc aims to commercialise Cervi-LOK, a screw-free spinal stabilisation system, in 2023.

The device aims to minimise the risk of vertebral artery injury which can cause brainstem stroke or nerve root and spinal cord injury.

The listed firm cited supply chain issues and external issues around testing as a reason for delays to securing FDA clearance in the United States.

“[These] centred around compression testing, a main test required by the FDA; however it was eventually determined that the issue was with the testing block rather than the Cervi-LOK product itself,” it stated.

“Following adjustments to the testing block all tests were successfully completed and are ready for submission to the FDA by the independent testing facility.

“The instrument set has [also] commenced final sterilisation testing with Puracon GmbH in Germany.”

The company’s loss before taxation for the six months to 30th September 2022 was £545k.

The £200,000 bridging loan and letter of intent for £2.4m of equity investment has been signed with an unnamed UK investment group.

TruSpine Technologies expects due diligence on the deal to be completed before the end of January, with the loan to be repaid by 30th June when the first of three tranches of equity funding is expected to be delivered.

Ian Roberts, CEO of TruSpine, commented: “The proposed equity funding will ensure that our ground-breaking first spinal stabilisation device, the Cervi-Lok, can continue on the 510k pathway through to FDA clearance and onto commercialisation.”

The company added: “Whilst we are disappointed by the delays and challenges encountered, the Board would like to thank shareholders for their support, and TruSpine’s staff and commercial partners for their hard work during the year.”