Listed MedTech TruSpine has reported another year of losses as it scrambles for survival.

For the year ended 29th March 2023, the pre-revenue company lost £853,000 before tax – compared with £941,000 in 2022 – with an R&D tax credit of £199,000 taking loss after tax to £654,000.

The firm stated this morning: “The group is reliant upon FDA approval subsequent sales and/or further financing to meet its working capital needs. There is no guarantee that these will be achieved… these events or conditions indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.”

TruSpine says it is in advanced discussions with a third party lender in relation to potential funding.

In May the board of TruSpine Technologies Plc survived a shareholder revolt. Laurence Strauss, who took over as CEO at the end of February, CFO Norman Lott and non-executive directors Annabel Schild and Nik Patel remained in post despite an effort to replace them with Todd Michael Cramer, Peter Houghton and Anthony Swoboda.

The shareholders who triggered the vote held 19.4% of shares in the business and the resolutions were defeated.

https://businesscloud.co.uk/medtech-50-uks-most-innovative-medical-technology-creators/

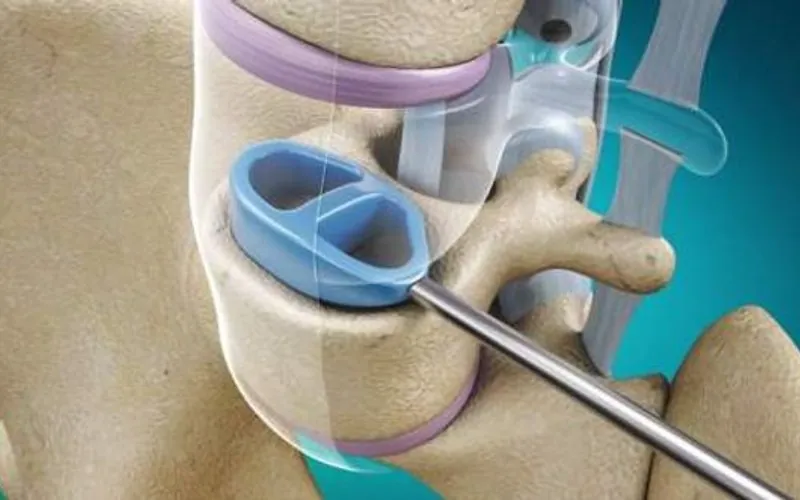

Based at London Gatwick, the medical device company is focused on the spinal stabilisation market. It is aiming to commercialise Cervi-LOK, a screw-free spinal stabilisation system which aims to minimise the risk of vertebral artery injury which can cause brainstem stroke or nerve root and spinal cord injury.

However, supply chain issues and external issues around testing delayed expected FDA clearance in the United States last year, leaving it seeking funding to see it through its FDA submission.

At the end of February, Ian Roberts stepped aside from the CEO role, with Strauss replacing him initially as interim managing director as an emergency loan was brought in. However further bridging loans failed to materialise, leading to a £100,000 loan agreement with NED Schild.

“This event caused significant distraction and disrupted our efforts to refocus the company during a crucial period,” Strauss said in a statement released this morning.

However, he sought to strike a bullish note on the company’s prospects. “Since my appointment, adjustments to the business, management structure and supply chain have provided the company with better operational clarity and control. While there is still work to be done, the company is now in a position to progress with confidence and a clear vision for achieving success.”

He said that the FDA application for Cervi-LOK was finally lodged in July this year.

TruSpine last year entered into a master agreement with Spartan Medical Inc to develop a strategic partnership and to provide funding, including an exclusive US reseller agreement to market and distribute the Cervi-LOK device to US government healthcare facilities once FDA clearance has been achieved.

The companies are now exploring a closer collaboration, with Spartan taking a more active management role in assisting TruSpine to bring its products to market in the US, once approved.