Payments tech firm Klarna, used by 9.5 million UK customers, has secured £500m new investment.

The equity funding round, at a post–money valuation of $10.65 billion, ranks Klarna as the highest-valued private FinTech in Europe and the fourth highest worldwide. It will now accelerate expansion primarily in the US, where it has nine million customers.

The Swedish firm’s app enables shoppers to spread payments for products over several instalments. It has more than 12m monthly active users worldwide, with 55,000 daily downloads, and has served more than 90m in all across 200,000 merchant partners.

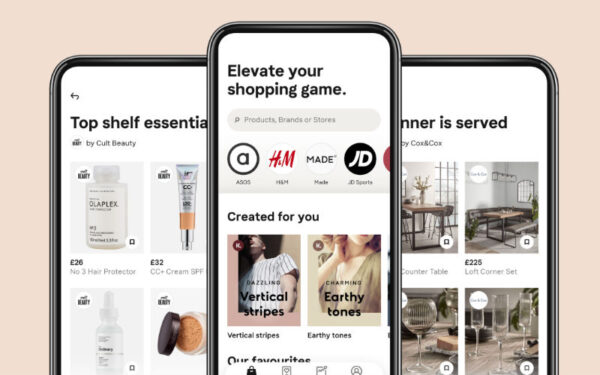

A ‘social shopping’ update to its app launched in the UK recently, allowing consumers to wishlist their favourite items, access discounts, set up price-drop notifications and track spending and deliveries.

Loyalty program Vibe – which rewards consumers who pay on time and is intended to encourage responsible spending – will soon be launched outside its first market, the US.

The inflow of new UK consumers since April has averaged more than 95,000 on a weekly basis. The average consumer age is 33.

“We are at a true inflection point in both retail and finance,” said CEO and co-founder Sebastian Siemiatkowski.

“The shift to online retail is now truly supercharged and there is a very tangible change in the behaviour of consumers who are now actively seeking services which offer convenience, flexibility and control in how they pay and an overall superior shopping experience.

“Klarna’s unique proposition, consumer preference and global retailer network will prove an excellent platform for further growth.

“The Klarna team is honoured to welcome such world class investors to support our mission to become the world’s favourite way to shop.”

The round was led by Silver Lake alongside GIC – Singapore’s sovereign wealth fund – as well as funds and accounts managed by BlackRock and HMI Capital.

Concurrently, Merian Chrysalis, TCV, Northzone and Bonnier have acquired shares from existing shareholders.

They will join current investors such as Sequoia Capital, Dragoneer, Permira, Commonwealth Bank of Australia, Bestseller Group and Ant Group in supporting Klarna’s future growth.

Silver Lake co-CEO Egon Durban and MD Jonathan Durham said: “Klarna is one of the most disruptive and promising fintech companies in the world, redefining the eCommerce experience for millions of consumers and global retailers, just as ecommerce growth is accelerating worldwide and rapidly shifting to mobile.

“Klarna’s retail partners benefit from incremental traffic and dramatically improved customer conversion. Consumers love Klarna for its differentiated app-based shopping experience and for their flexible and transparent payment options.

“We are excited to invest in the company and partner with Sebastian and his talented team at this dynamic time to help accelerate Klarna’s remarkable growth and success worldwide.”