Informa has divested Pharma Intelligence to private equity firm Warburg Pincus in a £1.9 billion deal.

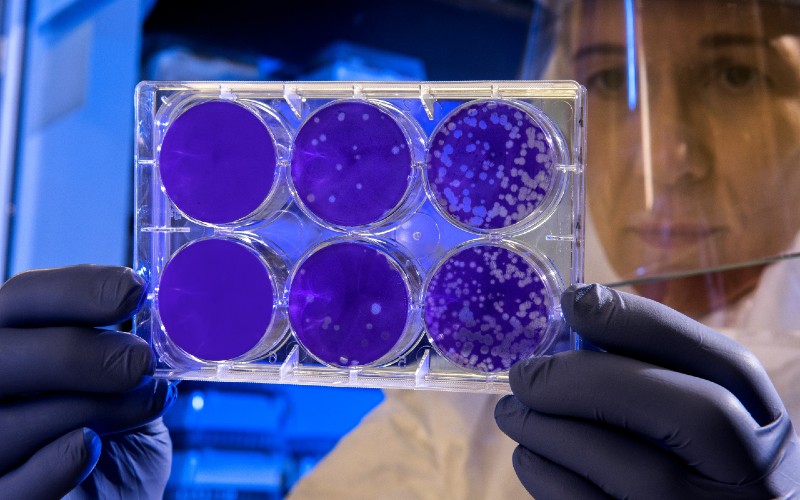

Pharma Intelligence is one of the world’s leading providers of data and intelligence on clinical trials, drug treatments and medical devices.

It was the largest business within London-listed Informa’s Intelligence division.

With 85% of equity value, equating to £1.7bn in cash, by the deal, Informa will retain a 15% shareholding in Pharma Intelligence going forward.

Informa has separately commenced a share buyback programme to return a proportion of the proceeds from the divestment to its shareholders.

The programme will commence with immediate effect and run through to the AGM in June. The maximum amount allocated to the initial tranche of the buyback programme will be £100 million.

“Since announcing the intention to divest our Informa Intelligence portfolio, we have received significant interest in its high-performing brand portfolio, leading to today’s binding agreement for Pharma Intelligence, which reflects the quality and value created in this business, as well as its significant future potential,” said Stephen A. Carter, group CEO at Informa.

In 2020, Pharma Intelligence accounted for approximately 40% of Informa Intelligence reported divisional revenues of £305m and 50% of reported divisional adjusted operating profit of £103m.

The divestment is expected to complete by early June subject to relevant regulatory clearances.

Adarsh Sarma, co-head of Europe at Warburg Pincus, said: “We are delighted to be the partner of choice for Informa and to have the opportunity to acquire Pharma Intelligence with its operating management team.

“Pharma Intelligence plays a critical role in supporting and maintaining the ecosystem that surrounds clinical trials, drug development and regulatory compliance, and we intend to invest and significantly grow the business and its product offerings.”