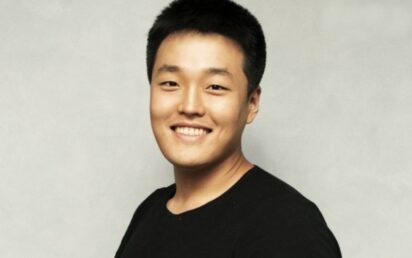

Do Kwon, co-founder of Terra, has been charged with fraud by the US Securities and Exchange Commission.

South Korea police and Interpol are hunting a figure whose current whereabouts are unknown.

The Terra ecosystem – which included the Luna cryptocurrency and algorithmic stablecoin TerraUSD (UST) – collapsed last year, leading to billions of losses for investors.

Regulator the SEC accused Kwon of “perpetuating a fraudulent scheme that led to the loss of at least $40 billion of market value”.

The suit added: “Terraform and Kwon also misled investors about one of the most important aspects of Terraform’s offering – the stability of UST, the algorithmic ‘stablecoin’ purportedly pegged to the US dollar.

“UST’s price falling below its $1 ‘peg’ and not quickly being restored by the algorithm would spell doom for the entire Terraform ecosystem, given that UST and LUNA had no reserve of assets or any other backing.”

When UST dropped 10 cents below $1, Kwon’s company Terraform Labs persuaded an unnamed US trading firm to buy UST to restore the peg, in exchange for Luna tokens.

“Almost immediately upon UST’s recovery in May 2021, Terraform and Kwon began to make materially misleading statements about how UST’s peg to the dollar was restored,” the suit said.

“Specifically, Terraform and Kwon emphasised the purported effectiveness of the algorithm underlying UST in maintaining UST pegged to the dollar – misleadingly omitting the true cause of UST’s re-peg: the deliberate intervention by the US trading firm to restore the peg.”

SEC director of enforcement Gurbir Grewal said the project “was neither decentralised, nor finance… it was simply a fraud propped up by a so-called algorithmic ‘stablecoin’ – the price of which was controlled by the defendants, not any code”.

The complaint also alleges that Kwon and Terraform falsely told their customers that Chai, the Korean electronic mobile payment app, used the Terraform blockchain to process payments.

Cardano Foundation appoints COO & legal chief

The Cardano Foundation has appointed Andreas Pletscher as its chief operating officer and Dr Nicolas Jacquemart as its chief legal officer.

The Foundation is an independent, Swiss-based non-profit responsible for stewarding the advancement of public blockchain Cardano, anchoring it as a baselayer for current and future financial and social systems.

Pletscher joins the Foundation from PwC while Jacquemart joins from FINMA, the Swiss financial market supervisory authority.

Frederik Gregaard, CEO of the Cardano Foundation, said: “I know they will have a massive impact on our mission: to improve the operational resilience and adoption of the Cardano blockchain while educating the world about the technology’s applications and potential.”

Pletscher has managed complex operational and IT transformation projects, working as technological director at PwC and IBM, and most recently led a large transformation for a crypto services provider in Switzerland.

“Frederik talks about operational resilience as one of the core focus areas of the Cardano Foundation’s strategy and I think that’s an excellent objective for any COO, but particularly one whose task is so bound up with technology, security, and community,” he said.

“I’m looking forward to supporting our teams to improve the performance and resilience of the Cardano blockchain, and I’ll do that by helping to improve the performance and resilience of the Cardano Foundation.”

Dr Jacquemart most recently worked on the FinTech desk at FINMA, Switzerland’s financial market supervisory authority, and previously held roles at high-profile law firms in Switzerland. He holds a PhD in law from the University of Zurich, where he studied the intersection of blockchain technology and financial market regulation.

“This is a fascinating time to be stepping into this role,” he added. “The Cardano Foundation is serious about legal engagement and education and interest in the blockchain space is pronounced.

“Opportunities for cooperation are abundant and I’m excited about working at the interface between the Cardano ecosystem, the wider blockchain community, regulators, and the legal profession.”

Cryptocurrency shorts

KnownOrigin, the NFT marketplace owned by eBay, is launching creator smart contracts for artists allowing them to split earnings and earn royalties as co-creators. 84 contracts have been deployed and 250 editions of NFTs minted in a beta release.

Warren Buffett’s business partner Charlie Munger is “making a fool of himself” for his “archaic, short-sighted and hypocritical” call for a US ban on crypto, says Nigel Green, CEO of deVere Group. “It’s inevitable that we will have a multi-faceted system of currencies moving forwards including fiat, central bank digital currencies and crypto. Those who demonstrably ‘get’ this: most governments, central banks, regulators, institutional investors, private investors, and financial institutions including Wall Street giants. Amongst those who demonstrably don’t ‘get’ this: Charlie Munger.”

Sending Labs has secured $12.5 million in seed funding to build a Web3 communication stack for secure chat, transactions and community-building. Insignia Venture Partners, MindWorks Capital and Signum Capital led the round.

GSR, a global crypto market maker and liquidity provider, has pledged an initial $10m to establish the GSR Foundation, an independent grantmaking charity that will support non-profit organisations across the world.

Sony Network Communications, a business division of The Sony Group, has partnered with smart contract network Astar Network to launch a Web3 incubation programme for NFT and decentralised projects.

Norway has seized a record $5.8m worth of cryptocurrency stolen by North Korean hackers last year. It is part of the $625m Axie Infinity hack haul.

Crypto prices

The overall market cap of the 22,500 coins is at $1.08 trillion at the time of writing (7am UK), a 2.8% decrease in the last 24 hours.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.