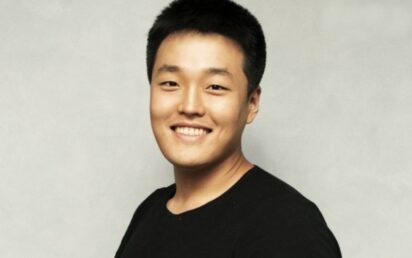

International fugitive Do Kwon, the CEO of collapsed cryptocurrency network Terraform Labs, has been arrested at an airport in Montenegro.

South Korea police and Interpol have been hunting Kwon, whose whereabouts were unknown, and five other people connected to Terraform for months.

The Terra ecosystem – which included the Luna cryptocurrency and algorithmic stablecoin TerraUSD (UST) – collapsed last year, leading to billions of losses for investors.

“Montenegrin police have detained a person suspected of being one of the most wanted fugitives, South Korean citizen, co-founder and CEO of Singapore-based Terraform Labs,” Montenegro’s Interior Minister Filip Adžić tweeted.

“We are waiting for official confirmation of identity.”

Montenegro’s interior ministry said two suspects were detained at Podgorica airport trying to board a plane to Dubai with forged Costa Rican and Belgian passports. Reports said three laptops and five mobile phones were taken from them.

Within hours federal prosecutors charged Kwon in New York on eight counts including commodities fraud, securities fraud, wire fraud, and conspiracy to defraud and engage in market manipulation.

US regulator the Securities and Exchange Commission had filed a lawsuit in February accusing Kwon of “perpetuating a fraudulent scheme that led to the loss of at least $40 billion of market value”.

The suit added: “Terraform and Kwon also misled investors about one of the most important aspects of Terraform’s offering – the stability of UST, the algorithmic ‘stablecoin’ purportedly pegged to the US dollar.

“UST’s price falling below its $1 ‘peg’ and not quickly being restored by the algorithm would spell doom for the entire Terraform ecosystem, given that UST and LUNA had no reserve of assets or any other backing.”

When UST dropped 10 cents below $1, Kwon’s company Terraform Labs persuaded an unnamed US trading firm to buy UST to restore the peg, in exchange for Luna tokens.

“Almost immediately upon UST’s recovery in May 2021, Terraform and Kwon began to make materially misleading statements about how UST’s peg to the dollar was restored,” the suit said.

“Specifically, Terraform and Kwon emphasised the purported effectiveness of the algorithm underlying UST in maintaining UST pegged to the dollar – misleadingly omitting the true cause of UST’s re-peg: the deliberate intervention by the US trading firm to restore the peg.”

SEC director of enforcement Gurbir Grewal said the project “was neither decentralised, nor finance… it was simply a fraud propped up by a so-called algorithmic ‘stablecoin’ – the price of which was controlled by the defendants, not any code”.

The complaint also alleges that Kwon and Terraform falsely told their customers that Chai, the Korean electronic mobile payment app, used the Terraform blockchain to process payments.

Coinmama partners with Volt

Cryptocurrency exchange platform Coinmama has partnered with Volt, a global gateway for real-time payments, to enable open banking payments for its customers across Europe and Brazil.

The partnership enables real-time deposits and payouts for customers buying and selling cryptocurrencies.

Open banking payments eliminate the friction created by legacy payment methods for cryptocurrency trading, as card payments have long settlement times of up to 3-5 business days, and traditional bank transfers are potentially blocked as some banks enforce crypto bans to mitigate fraudulent activity.

Volt’s payment solutions are near-instant and enable customers to have full control of their funds. Coinmama is leveraging Volt’s hosted checkout page, which simplifies operations in European markets and enables customers to authorise transactions using their preferred authentication methods, usually via biometrics such as fingerprint recognition or face ID.

Cryptocurrency shorts

Epic Games CEO Tim Sweeney says Apple “will either try to crash the metaverse or extract all profit from it”. Speaking to GamesIndustry at the Game Developers Conference, the boss of the Fortnite maker said he wants to see an open metaverse, rather than “another walled garden”.

Bankrupt cryptocurrency exchange FTX is looking to sell its stake in Mysten Labs for $96 million to return value to customers. It led a $300m Series B fundraising round for Mysten Labs in August 2022 which valued the company, building Ethereum competitor the Sui Blockchain, at $2bn.

Quasar Finance, a decentralised asset management protocol based on the Cosmos blockchain ecosystem, is launching its mainnet to help investors manage digital assets across multiple blockchains.

Kyle Davies, co-founder of bankrupt crypto hedge fund Three Arrows Capital, has been ordered to answer a subpoena issued in January or risk being held in contempt of court.

Anatoly Aksakov, a Russian MP behind its nascent crypto legislation, says Bitcoin has “no future” – and claims ruble-backed coins will prevail instead.

Crypto prices

The overall market cap of the 23,000 coins is at $1.18 trillion at the time of writing (7am UK), a 2.2% increase in the last 24 hours.

For round-ups of recent cryptocurrency news developments, click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.