The founder of the collapsed Terra blockchain has said he is “heartbroken” after the LUNA cryptocurrency and its sister stablecoin UST lost practically all their value in just a week.

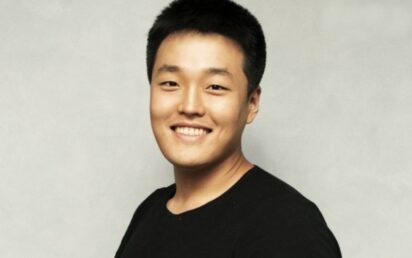

Do Kwon, founder of Terraform Labs – which powers the Terra blockchain – tweeted that he had “spent the last few days on the phone calling Terra community members”.

“Builders, community members, employees, friends and family, that have been devastated by UST depegging… I am heartbroken about the pain my invention has brought on all of you,” he said.

“I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.”

He claimed that he or his companies did not profit from the bloodbath, nor did he sell any holdings in either currency during the crisis.

As a stablecoin, UST’s raison d’etre is to provide a place for investors to swap out their cryptocurrency holdings in a stable fashion compared with the volatility of other currencies.

However, unlike other stablecoins, it did not do so through holding traditional assets such as US dollars. As UST depegged from its supposedly stable $1 valuation, the Luna Foundation Guard (LFG) – in charge of maintaining the peg – deployed $1.5 billion worth of BTC last Monday to add liquidity to the ecosystem. It also loaned out coins to trading firms and 750 million UST tokens to accumulate BTC. The latter move has been criticised for having an inflationary impact.

Do Kwon tweeted at the time: “Deploying more capital – Steady lads.”

“We are currently working on documenting the use of the LFG BTC reserves during the depegging event. Please be patient with us as our teams are juggling multiple tasks at the same time,” his most recent thread continued.

“What we should look to preserve now is the community and developers that make Terra’s blockspace valuable – I’m sure our community will form consensus around the best path forward for itself, and find a way to rise again.”

He seemed to suggest a revival plan to hard fork the Terra blockchain at a previous moment in time and issue a percentage of tokens to holders.

Changpeng Zhao, CEO of crypto exchange Binance, tweeted that such a move simply “won’t work”.

Instead, he suggested that the community could use its Bitcoin reserves to buy back UST and ‘burn’ it to revive value.

He tweeted: “These past weeks have proven to be a watershed moment for the crypto industry. We have witnessed the rapid decline of a major project, which sent ripples across the industry, but also a new found resiliency in the market that did not exist during the last market downswing.

“Binance Labs invested in hundreds of projects over the last 4 years, including exchange ‘competitors’ and many ‘competing’ blockchains. A few of them have fallen by the wayside, but a few have been extremely successful. That’s how investments work.

“The last few days, we tried hard to support the Terra community. Minting, forking, don’t create value. Buying back, burning does, but requires funds. Funds that the project team may not have.

“In this regard, I would like to see more transparency from them. Much more! Including specific on-chain transactions (txids) of all the funds. Relying on 3rd party analysis is not sufficient or accurate. This is the first thing that should have happened.

“I am not always right, but my perspective is: Failures can/will happen. But when they do, transparency, speedy communication and owning responsibility to the community is extremely important.

“I am just hoping that the project teams can rise from the ashes and rebuild in a proper and sensible way. Regardless of my personal views, or the solution chosen in the end, we will always be here to support the community in any way we can.”

Goldman Sachs & Barclays back digital asset platform Elwood

Goldman Sachs has backed Elwood Technologies, a digital asset platform for institutional investors.

The investment bank co-led a $70 million Series A round into Elwood, which aims to simplify entry to the space, alongside Dawn Capital.

There was additional participation from prominent investors in both the traditional finance and digital asset industries, including Barclays, BlockFi Ventures, Chimera Ventures, CommerzVentures, Digital Currency Group, Flow Traders and Galaxy Digital Ventures.

Elwood will deploy the funds to meet the needs of its rising number of institutional clients by expanding both the company’s breadth of product offerings and its global operations.

“Elwood was established to meet the needs of institutions seeking to secure exposure to digital assets by providing a robust and transparent platform which delivers the highest standards expected in traditional finance,” said James Stickland, CEO of Elwood Technologies.

“We have entered a new chapter in Elwood’s journey and continue to expand our capabilities, enabling our institutional clients to provide their users with improved access to digital assets. The rich mix of investors participating in this raise reaffirms the movement of financial institutions working closely with their native digital asset technology providers.

“Together, we aim to provide broader mass market involvement in digital assets and cryptocurrency. We look forward to working with our investors to further enhance our offerings and broaden their market adoption.”

The solution provides execution, liquidity, market connectivity, reporting and analytics. It is already being utilised by FinTechs, asset managers and FI clients.

Mathew McDermott, global head of digital assets at Goldman Sachs, commented: “As institutional demand for cryptocurrency rises, we have been actively broadening our market presence and capabilities to cater for client demand.

“Our investment in Elwood demonstrates our continued commitment to digital assets and we look forward to partnering to expand our capabilities.”

Cryptocurrency shorts

US financial services regulator the Securities and Exchange Commission has hinted that it could develop stricter rules around stablecoins following the UST depeg. Commissioner Hester Peirce, known to be forward-thinking around the cryptocurrency space, said: “There are different potential options for approaching stablecoins… and with experimentation, we need to allow room for there to be a failure.”

As Tesla CEO Elon Musk puts his Twitter takeover plans on hold over the number of automated accounts on the platform, ZeNPulsar research has found that 48% of posts on topics relating to stocks and cryptocurrencies on the platform are made by bots. “This is clearly a huge proportion of the conversation and is an example of why social media companies have tried so hard to tackle their use,” the company stated.

Crypto prices

The overall market cap of the more than 19,400 coins is at $1.30 trillion at the time of writing (7am UK), down from $1.32tr on Friday morning.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – dropped around $275 to $30,275. BTC is down 10% in a week.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – fell $50 to around $2,050. ETH is 16% down over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token shed $7 to $298, leaving it 14% down over seven days.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP fell 3 cents to 42 cents, which leaves it 25% down over seven days.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, dropped less than 2c to below 57c. It is 20% down over the course of a week.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token gained $3 to $55 yet is down 26% compared with a week ago.

Meme coin DOGE was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE dropped slightly to below 9c, leaving it 27% down in a week.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, added more than $1 to $11.27 but is 12% lower than its price a week ago.

Avalanche is a lightning-quick verifiable platform for institutions, enterprises and governments. Its AVAX token fell more than $1 to $33.78 and is 33% down in a week.

The Terra blockchain powering LUNA – described as a programmable money for the internet and as high as $117 little more than a month ago – has been halted after LUNA plummeted to just a fraction of a cent and stablecoin UST depegged from the dollar.

To see how the valuations of the main coins have changed in recent times – and for round-ups of recent cryptocurrency news developments – click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.