Binance has committed $1 billion to prop up the crypto industry following the collapse of rival exchange FTX.

The initial commitments to a recovery fund may increase to $2bn later “if the need arises”, according to the company.

It has also received $50 million in commitments from investment firms including Jump Crypto, Polygon Ventures and Animoca Brands.

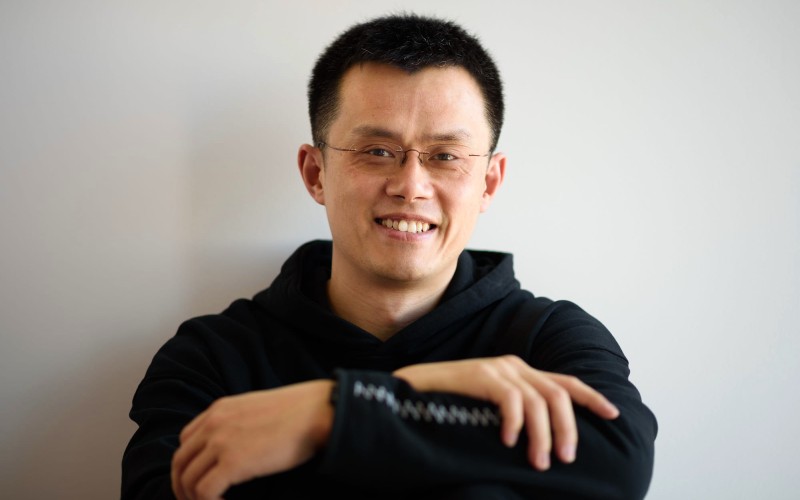

The public wallet address containing its initial commitment – in its own BUSD stablecoin – was shared by Binance CEO Changpeng Zhao.

“We do this transparently,” he wrote.

It is intended as a support fund for projects that are facing financial difficulties, Binance said, and not as a traditional investment vehicle.

Expected to last around six months, it has already received around 150 applications.

The irony of Binance emerging as a ‘white knight’ for the industry is that FTX itself played that role amid the crypto winter – investing in a number of ailing firms – prior to its bankruptcy.

Zhao served as a trigger for the demise of FTX by highlighting concerns over its holdings and liquidity, leading to a ‘bank run’ of users looking to withdraw their funds which it could not honour.

Meanwhile the CEO has confirmed that the exchange’s US arm will make a fresh bid for bankrupt crypto lender Voyager now that FTX is unable to follow through with acquiring it.

UK approves anti-terror crypto seizures

The UK Parliament has voted in favour of rules making it easier for law enforcement to seize crypto linked to terrorist activity.

Politicians had already approved amendments to the Economic Crime and Corporate Transparency bill which will hand powers to local enforcement to seize, freeze and recover crypto linked to criminal activity.

In its second reading in the House of Commons, further amendments to the bill called for these measures to be mirrored in existing counter-terrorism legislation.

Cryptocurrency shorts

Decentralised finance project Ardana has halted development due to “funding and project timeline uncertainty”. Built on the Cardano blockchain and aiming to provide stablecoin minting and foreign exchange services, it raised $10m last year in a funding round led by collapsed crypto hedge fund Three Arrows Capital, Cardano’s cFund and Ascensive Assets.

Nucleo has raised $4m seed funding to build privacy crypto infrastructure. The round was led by Bain Capital Crypto and 6th Man Ventures.

Crypto exchange Bybit has established a $100m fund to support institutional clients during the crypto bear market. It will offer up to $10m to existing and new ‘market makers’ on its platform.

Belgium’s financial regulator says Bitcoin (BTC), Ether (ETH) and many other cryptocurrencies do not constitute securities. It said a cryptocurrency is only classed as a security if it is issued by an individual or entity, rather than solely by computer code.

Russia is looking to launch a national crypto exchange, supported by both the Ministry of Finance and the Central Bank of Russia, which tend to disagree over crypto regulation in the country.

Coreto has launched a #ReputationisKING campaign, calling for people to share their experiences with crypto so others can learn from them. This is in response to scams and rug pulls, which were responsible for $2.8bn in losses in 2021 alone.

Crypto prices

The overall market cap of the 21,800 coins is at $827 billion at the time of writing (7am UK), a 1.3% decrease in the last 24 hours.

For round-ups of recent cryptocurrency news developments, click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.