A blockchain startup founded by billionaire Adam Neumann to tokenise carbon credits has been put on hold.

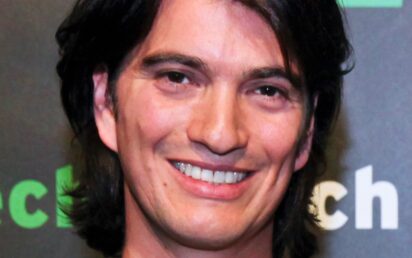

The founder of WeWork and his wife Rebekah are among the founders of Flowcarbon, which raised $70 million just two months ago to build an on-chain market for carbon credits.

Neumann was ousted as CEO of co-working giant WeWork three years ago when a failed flotation highlighted serious issues of governance at the company, currently being dramatised by Apple TV.

Each carbon credit represents a metric ton of carbon dioxide removed or prevented from entering the atmosphere by a project. When bought by a corporate company, they confer the right to claim an offset when retired – forever taking it off the market.

Flowcarbon, Toucan Protocol and KlimaDAO aim to convert those credits into crypto tokens, which can then be traded on the blockchain and ‘burned’ when the company retires the credit to claim an offset.

Billions of dollars of these tokens have been traded since Toucan and KlimaDAO launched in October 2021, equating to 23m carbon credits in the six months to March 2022. However just 2% of those have been used to offset emissions to date.

There has been criticism that they obscure the true purpose of carbon credits. “If people are now buying those tokens because they see it’s a money-making machine… I think that’s potentially unhealthy,” Guy Turner, the CEO of Trove Research, told The Wall Street Journal.

Now carbon credit registry Verra – the Verified Carbon Standard – has announced that credits it has created cannot be used to create new tokens due to confusion over the process.

Flowcarbon said it was waiting for the cryptocurrency markets to ‘stabilise’ before launching its Goddess Nature Token (GNT), which was intended to go live in June.

The recent $70m funding round was led by a16z crypto and included General Catalyst, Samsung Next, Invesco Private Capital, 166 2nd, Sam and Ashley Levinson, Kevin Turen, RSE Ventures and Allegory Labs.

Other participants in the token sale include Fifth Wall, Box Group and the Celo Foundation.

4,500 journey into Otherside Metaverse

Around 4,500 people have taken the first trip into the metaverse of NFT project Otherside.

Created by Yuga Labs, the company behind the popular Bored Ape Yacht Club NFTs, the tech demo was open to people who had purchased Otherdeeds, plots of virtual land there.

Following a giant Bored Ape through a portal into a ‘Biogenic Swamp’, they then made their way to a stadium where they could play with avatar dynamics such as dancing, running, jumping and emojis. They then explored the wider area, which featured monsters.

Yuga Labs then released details of the first part of its plan for Otherside: an 11-part storyline game mode surrounding a ‘mysterious Obelisk’ while users will be able to explore what can “be harvested, crafted, traded, bought, and sold” in the game.

There are 200,000 plots of virtual land in Otherside, with the cheapest currently costing $3,900.

Such an incredible experience. @OthersideMeta

Here are my favorite screenshots from the first trip: pic.twitter.com/XiQkwp9SZm— WRΞN (@wrencrypt) July 16, 2022

Cryptocurrency shorts

Russian President Vladimir Putin has signed a bill prohibiting the use of digital assets in the country to pay for goods and services. It is not illegal to own crypto in Russia.

US Securities and Exchange Commission chairman Gary Gensler says it could tailor securities laws for the crypto industry to protect investors. “If you are raising money from the public, and the public is anticipating profits based on the efforts of that common enterprise, that’s a security,” he said, adding: “There’s a potential path forward. I’ve said to the industry, to the lending platforms, to the trading platforms: ‘Come in, talk to us.’” He also compared stablecoins to poker chips.

Egyptian blockchain provider and NFT market Remooz has soft-launched an NFT marketplace called Minimum Viable Product (MVP), which will offer a free, user-friendly, socially engaging platform in which the digital assets can be traded.

eukhost – a fully managed WordPress hosting provider for bloggers

Crypto prices

The overall market cap of the more than 20,200 coins is at $996.4 billion at the time of writing (7am UK), up from $927.2bn on Friday morning.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – gained more than $1,100 to $21,775. BTC is 6% up in a week.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – added $230 to $1,430. ETH is 25% up over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token added $20 to $258, leaving it 12% up over seven days.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP gained almost 2.5 cents to 36.4 cents, with its price 14% up on seven days ago.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, gained 3c to 47c and is 4% up in a week.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token jumped more than $4.50 to $41.88 and is 18% higher than its price a week ago.

Meme coin DOGE was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE climbed 0.3c to approach 6.6c, leaving it where it was a week ago.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, grew more than 50c to $7.37 and is 9% up on its price a week ago.

Avalanche is a lightning-quick verifiable platform for institutions, enterprises and governments. Its AVAX token rose $3.50 to $23.26 and is 26% up in a week.

To see how the valuations of the main coins have changed in recent times – and for round-ups of recent cryptocurrency news developments – click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.