Revolut offers virtual financial solutions to customers around the world. The company is based in the UK and is part of the booming fintech industry. After starting out mainly as a travel card provider, Revolut has now grown into a full digital banking system with an online virtual account.

It is used by many people to send and receive money quickly and easily. For example, friends can add each other as contacts within the app and transfer cash to each other instantly. You can also receive refunds and payouts from companies. For example, a Revolut casino allows gamblers to withdraw any winnings back to their account with ease.

But not everyone wants to keep cash in their account forever. If this applies to you, then you’ll need to know how to withdraw from Revolut. And there are a variety of ways to do this. So let’s explain how you can get hold of your money.

1. Withdraw money from Revolut to bank

The most common way to transfer money is to send it back to your traditional bank account. It’s generally pretty easy to do – but there are different fees for sending money that you should be aware of.

Once you’re good to go, here’s how to withdraw money from Revolut to your bank:

1. Go to your wallet and tap ‘Transfer’

2. Hit the ‘+New’ option and choose ‘Bank recipient’ or ‘Card recipient’

3. Enter your bank account details or bank card details

4. Choose how much money you want to send

5. Check and confirm all the details are correct

The money will then be sent. Sometimes the payment is done as a local bank transfer. So the cash is generally sent pretty quickly. But if it’s sent as an international transfer (using an IBAN account) then this can take longer.

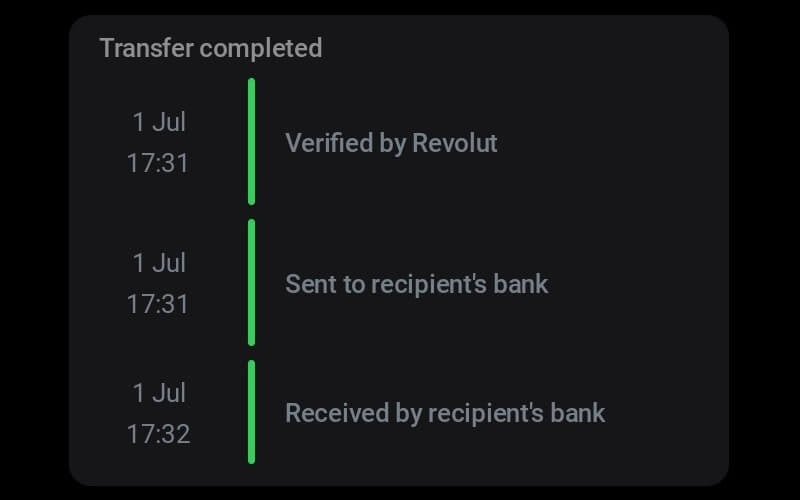

You will be kept up to date on the transfer’s progress in the app, as shown here:

If you are going to be withdrawing money from Revolut to your bank regularly, then you have the option to save your account details. This means you just need to choose the account and decide how much money you want to send. We recommend doing this for recurring transfers as it’s quite a big time saver.

2. Take money out of an ATM using your Revolut card

You can withdraw money from ATMs using your Revolut card too. It works in pretty much the same way as you’d get cash out when using a bank card. However, you need to prepare a few things.

To begin, make sure your card is active and not frozen. To check, go to the ‘Cards’ section in the app. If it is frozen, then the withdrawal will be declined – so make sure to activate the card you want to use.

Next, you need to check that the ATM will accept your card. Luckily, most Revolut cards are issued by either Visa or Mastercard, such as this:

Most ATMs accept Visa and Mastercard so you should be able to get cash quite easily.

Then just just follow the usual steps to withdraw:

1. Input your card

2. Enter your PIN

3. Select how much cash you want

4. Confirm the withdrawal

You will receive a push notification on your phone confirming the amount of cash that has been taken out.

How to withdraw from a foreign ATM with Revolut

If the currency you want to withdraw is the same as the currency in your Revolut account, then you can follow the instructions above with no issues. This is the case even when using a foreign ATM. For example, if you go on holiday to Spain but you have euros in your wallet, the ATM withdrawal will be taken from your euros amount.

But if you want to withdraw in a different currency then you need to be careful. That’s because a lot of foreign ATMs will offer you a fixed exchange rate based on your currency. For example, if you wanted to get euros but you only have British pounds in your Revolut account, the machine might offer to give you a fixed rate in British pound.

However, this is often a worse exchange rate. So always select to withdraw in the local currency – the ‘Without conversion’ option. This will give you Revolut’s exchange rate which will almost certainly be better and save you money.

ATM fees and limits

Depending on your Revolut plan, there may be a limit on how much cash you can withdraw for free before a fee is charged. You can check the current usage limits to find out how much you can take out for free each month. If you go over this, then a fair usage fee will apply until your limit resets.

Also, the ATM itself may include a fee for withdrawing cash. You’ll need to decide whether to accept the fee or try and find a different machine without a fee.

Does Revolut charge to withdraw cash abroad?

Revolut only charges an ATM withdrawal fee if you go over your monthly limit. Otherwise, it’s free for both national and international cash withdrawals.

But, as mentioned above, the ATM might charge a fee itself. If that’s the case, there’s no way to avoid this. And, again, always choose the local currency to get the best exchange rate.

3. Withdraw crypto from Revolut

If you’ve bought any cryptocurrency, then it’s possible to withdraw it to an external crypto wallet that you can control – such as a Ledger or Trezor. In this case, the crypto will be transferred through the blockchain.

To make a crypto withdrawal via Revolut, just follow these instructions:

1. Select the ‘Crypto’ option under the app

2. Load the menu button by selecting the three dots and select ‘Send’

3. Select ‘Wallets’ where you can add an address using a QR code or by typing it in manually

4. Enter how much crypto you want to send

5. Confirm the transaction

It’s really important to remember that a crypto withdrawal is not reversible once confirmed. So make sure to check that all the details are correct.