It starts small. A wire transfer here, a currency exchange there. A few euros shaved off for “processing.” Maybe it’s €6, maybe it’s €18. Nothing outrageous – until you realise it’s happening with every transaction, every month, across every border.

Suddenly you’re spending thousands a year just to move your money.

If you run a business in the UK or Europe, you’ve probably come to accept it. The slow transfers, the inconsistent FX rates, the hidden charges that appear without a warning. Traditional banking and many modern financial institutions make this friction feel normal, even inevitable.

But it isn’t.

The cost isn’t just financial. It’s operational. Businesses wait days to settle payments that should clear in hours. Cash flow planning becomes a guessing game. International expansion is delayed not because there’s no demand, but because basic infrastructure can’t keep up. Founders and CFOs waste time on customer service calls that go nowhere, trying to fix problems that shouldn’t exist in the first place.

For companies dealing with cross-border payments, especially high-value transactions, these inefficiencies quietly erode margins, trust, and speed. And the worst part is – most of it is avoidable.

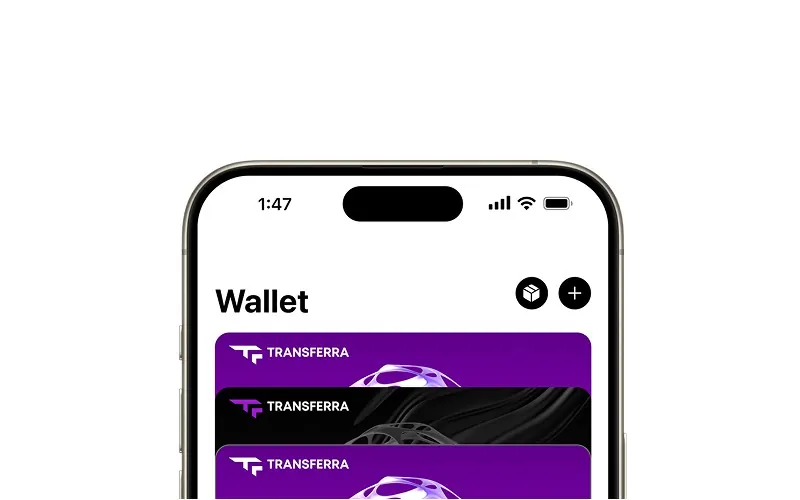

That’s exactly why we built Transferra. It’s a financial platform designed to eliminate that friction. Businesses get a universal IBAN account that works across the UK and EEA. Payments move quickly via SWIFT, SEPA, BACS, CHAPS, and Faster Payments. Currency conversion is transparent, fair and lower the mid-market rates. And every transaction comes with clarity.

Take a typical case. A London-based agency pays €20,000 per month to freelancers and contractors in Cyprus. Through a traditional bank, they lose up to £600 each month in FX markups and hidden fees. Over a year, that’s more than £7,000, not counting the hours lost in follow-ups, delays, and accounting errors. With Transferra, those costs shrink by up to 80%. Not because we’re running a promo, because we built our platform differently.

We aren’t a glossy neobank designed for personal finance or a cashback scheme for startups. Transferra is built for operational efficiency, for real companies that care about accuracy and speed.

The biggest cost most companies face isn’t a line item, it’s the slow bleed of outdated infrastructure. For years, businesses have been conditioned to accept delays, ambiguity, and hidden fees as the price of doing business across borders. But once better systems exist, that excuse disappears. The companies that grow faster, operate leaner, and expand with confidence aren’t doing anything radical. They’re just choosing tools that aren’t working against them.