Private capital raising platform HUBX has secured £4 million in new funding.

European B2B technology venture fund Basinghall Partners, together with Barclays, ELITE and individual investors, participated in the London FinTech start-up’s latest funding round.

The investment will be used to accelerate HUBX’s product roadmap, grow the team and scale its marketing and distribution capability.

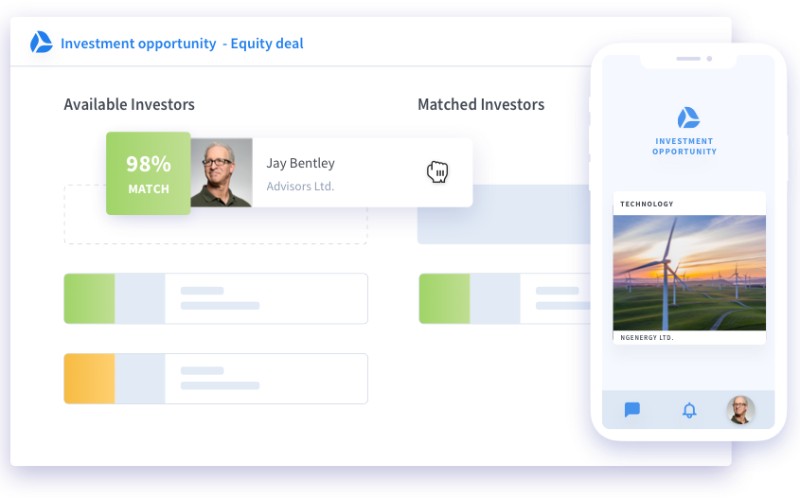

Founded in 2015, HUBX is simplifying and connecting the private capital raising and distribution processes. Its technology leverages automation and data insights to help organisations execute transactions faster, collaborate and gain deeper insights into their networks.

HUBX, which integrates its cloud APIs with start-ups, banks, brokers and exchanges, saw a surge in demand for its digital capital markets solutions in 2020, with organisations seeking digital transformation at an accelerated pace.

By connecting front office activities with core back office systems, institutions can fully digitise their capital raising activities and accelerate their digital transformation while leveraging legacy infrastructure.

“There’s tremendous potential in helping organisations digitise their private capital raising and distribution activities, with current conditions accelerating the trend towards the digitisation of all transactions end-to-end,” said Axel Coustere.

“We are delighted that our investors are seeing the significant opportunity to transform private financing globally.”

Andrew Irvine from Basinghall Partners added: “We are pleased to add HUBX to our portfolio and look forward to providing our network and knowledge base to further enable the HUBX opportunity.

“Simplifying and connecting private capital markets with the latest technology is an exciting and topical prospect.”