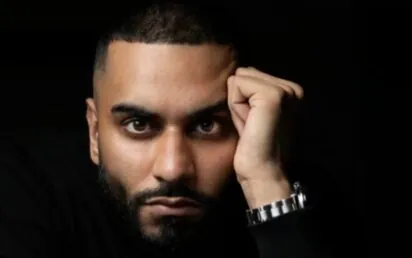

As befits a man who has lived much of his life on social media, Umar Kamani was never going to issue a standard press release to signal his return to PrettyLittleThing.

Eighteen months after announcing he was stepping down as CEO of the fashion retailer he set up with brother Adam, the 36-year-old is back with a stylish bang.

Fresh from getting married to his wife Nada in a four-day extravaganza reported to have cost £20m, he told his 1.2m Instagram followers and 43,000 followers on LinkedIn about his ‘excitement and heartfelt determination’ to transform the fortunes of PrettyLittleThing.

“Over the past few years, I’ve watched from the sidelines as the brand we built together has, at times, lost touch with what made it so special – you, our loyal customers,” he wrote.

“This has driven me to step back in and take on the responsibility of steering PrettyLittleThing forward, putting your needs and desires at the forefront of every decision we make.

“For the past 12 years, you’ve shown incredible loyalty and love for PrettyLittleThing and for that, I hold you and the brand close to my heart.

“Together we have created something truly special and I promise you that my full focus and energy will be dedicated to understanding your needs, listening to your feedback, and evolving the brand alongside you.”

It’s not known what position he’s returning to, but it will be a senior leadership role alongside chief operating officer Tom Binns and chief marketing officer Nicki Capstick.

What’s obvious is he’s returning to a very different beast to the one that he left.

Challenges

A combination of the cost-of-living crisis, supply chain challenges, inflation and competition from the likes of Shein has resulted in a dip in PLT’s profits.

One of the biggest challenges has been the rise in the return rate to pre-pandemic levels.

It prompted PrettyLittleThing to start charging customers £1.99 to return clothes, with the cost deducted from their refund.

It prompted a furious response from customers and, tellingly, Kamani’s first act has been to reverse that decision.

In his statement, Kamani wrote: “As part of the renewed commitment, one of my first changes will be to reintroduce free returns for our royalty customers, a step I believe is vital to making your shopping experience more seamless and enjoyable.

Public apology

“I sincerely apologise for any negative experiences you may have encountered during my absence. I take full responsibility from this moment on, and I am committed to making sure your experiences with us are nothing short of exceptional moving forward.

“Thank you for your continued support and for giving me the opportunity to guide PrettyLittleThing into its next exciting chapter. I won’t let you down. We’ve always been one big PLT family, and now we will be stronger than ever.”

The latest announcement is a far cry from Kamani’s statement – also made on social media – in April 2023 that he was stepping down as CEO of PrettyLittleThing.

At the time he’d grown the fast fashion retailer into a £700m revenue business with a valuation of £3.8bn on the back of a strategy of celebrity endorsement from the likes of the Kardashians.

Launched in 2012, PrettyLittleThing became a global name and promised ‘to help every girl feel like a celebrity with her clothes’.

Kamani sold his 34% stake in PLT to father Mahmud Kamani, CEO of Boohoo, in 2020 for £330m.

In 2021 Molly-Mae Hague was appointed creative director for the UK and EU. Just two years later, Kamani said he was at a “stage in my life where I need to set myself new challenges and goals and build new brands”.

Disneyland

He added: “If you know me, you’ll know Disneyland and all the magic surrounding it has always been one of my biggest inspirations.

“This is what I wanted to create with PrettyLittleThing, a fairytale-like world where unicorns exist, and anything is possible. Here’s to the future, creating more magic and fairytales.”

By way of background, PLT is part of the Boohoo Group, which was co-founded by his father Mahmud and Carol Kane in 2006.

Earlier this week, Manchester-headquartered Boohoo Group announced it will be closing its US distribution centre in Pennsylvania and will be fulfilling its US orders from its automated UK distribution centre in Sheffield.

It hints at a change in strategy – but Kamani won’t be short of things to do, judging by the responses his announcement on social media attracted.

Chris Ashton-Green, founder and CEO of Regit.cars, urged him to end their association with the buy now, pay later platform Klarna. “No teenager should be getting in debt for a £25 dress,” he said.

Fractional CMO Kieran Stott added: “Fashion brands need to accept returns are an essential part of the customer journey, especially if solely online. Why should any customer be punished for poor quality or fit of an item they have never seen or tried on?”

Letitia Oglesby, marketing manager at Elizabeth Norman International, said the returning Kamani needs to put quality and sustainability at the top of his priority list.

“Over the years, quality has become much worse to reduce costs and churn out more clothing, which then has an impact on waste,” she claimed. “This seems like an attempt to pull the brand back because it’s clearly suffering – the recent changes to returns and blocking loyal customer accounts didn’t help.

“Efforts should be focused on the bigger picture issues. Charging for returns doesn’t reduce waste, improving the quality of your products does.”

Nicole Taliotis, senior product designer of The National Lottery, had just one question for Kamani: “Please can you also allow everyone that was cancelled / barred from ordering due to ‘high returns’ to be able to create an account again,” she said.

Share price

Shareholders in Boohoo will also be hoping Kamani’s return can help boost the company’s share price of 28p – a far cry from the £4.13 level of June 2000.

Dr Muddassir Ahmed told the returning Kamani on LinkedIn: “I hope your return [will] have some positive impact on Boohoo’s share price. I am sitting on 11,000 shares I bought at £2.78 in [the] good days and [have] since tanked [to] £0.2854. Some recovery on my losses will be great.”