A Manchester startup has won £630,000 in government backing to treat brain cancer with electricity.

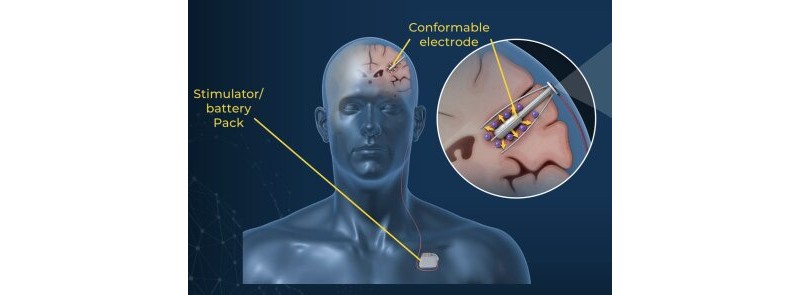

QV Bioelectronics is working on GRACE, a novel minimally invasive implant using electric fields that could be placed when performing the standard surgical procedure.

The #1 killer cancer for children and adults below 40, brain tumours have taken away notable people such as Dame Tessa Jowell, US Senator John McCain, footballer Paul Mariner, actor Paul Ritter and four-year-old Grace Kelly.

Recently, Tom Parker, singer of The Wanted, has been receiving treatment for an inoperable tumour.

While several research avenues are being explored, from new and retargeted drugs, vaccines, oncolytic viruses and implants using ultrasounds to open the blood-brain barrier, most are still at the research stage.

A commercial solution offered by the US-based Novocure, currently worth close to $7 billion on NASDAQ, uses electric fields to disrupt tumour growth and kill cancer cells, but costs over $20,000 per month per patient and requires transcranial wires, bulky batteries and daily head shaving.

Clinical trials

QV Bioelectronics recently raised more than $1 million from investors Consilience Ventures, SOSV, the GM & Cheshire Life Sciences Fund and several angel investors. It says the grant from Innovate UK will take the treatment closer to clinical trials.

“In my practice as a neurosurgeon, the best standard of care combining surgery, chemotherapy and radiotherapy still has a desperately poor prognosis, with a 12 months life expectancy and ~3% survival chance after five years,” said clinical director Dr Richard Fu, a, former NIHR academic clinical fellow in neurosurgery.

“This is what led me to co-found QV Bioelectronics to improve patient outcomes.”

The startup is preparing for animal trials in 2022.

Dr Chris Bullock, CEO of QV Bioelectronics, added: “This significant funding from Innovate UK will support preclinical studies of QV Bioelectronics’ GRACE device, enabling us to take several big strides forwards towards human clinical trials.

“The highly competitive nature of the grants, with rigorous technical assessment, de-risks follow-on venture capital investment.”