An Australian company is eyeing a hostile takeover of SmartSpace Software plc.

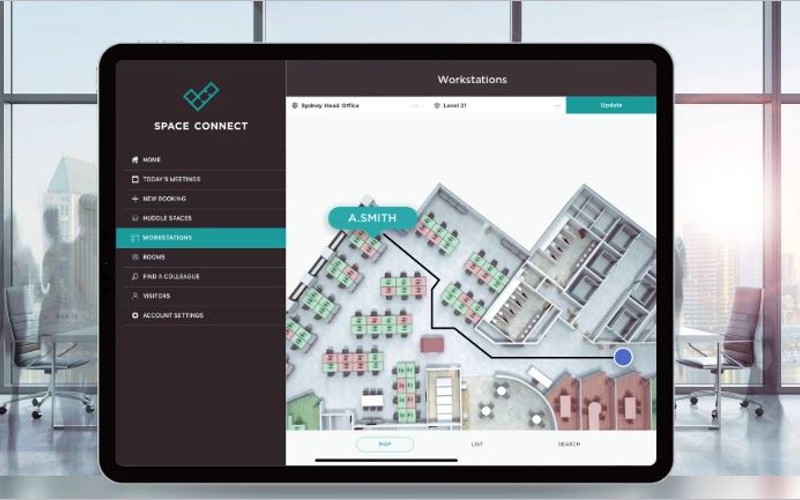

The Suffolk firm provides digital workspace technologies including sign-in software SwipedOn and Space Connect, which facilitates meeting room bookings, desk management and tracking of data.

Skedda, headquartered in Melbourne with a base in Boston in the United States, develops workplace management software.

It said it has made a series of proposals to the board of directors of SmartSpace regarding a possible cash offer, most recently at a price of 82p per share. This values Smartspace at £25 million and represents a premium of approximately 144.8% to the middle market closing price of 33.5p on Monday.

The firm’s share price has dropped to around the 40p mark this year, half of that seen towards the end of 2021. It reached 178p during COVID, a peak in recent years but still a far cry from the 33,000p price at IPO in 2005.

The share price doubled to above 65p in the first 90 minutes of trading this morning.

Skedda said it has the support of SmartSpace’s largest shareholder JO Hambro Capital Management Limited – which holds 8.3% of the company – but the company’s board “has not been willing to date to provide support for the proposal”.

It said a firm offer may therefore not be made, and also warned that it may instead make another offer on less favourable terms, should support not be forthcoming.

“Skedda believes that it can provide SmartSpace with the considerable financial support and technical expertise that Skedda believes will be necessary for SmartSpace to maintain its technological advantage in a rapidly developing and increasingly competitive sector,” it said.

“Skedda also sees a strong commercial advantage for SmartSpace’s customers and a compelling opportunity for SmartSpace’s employees within an international, growing and more resilient organisation.”

Under public market rules, Skedda has until 5pm on 9th January to announce either a firm intention to make an offer for SmartSpace or that it does not intend to make an offer.

UPDATE 13/12/23: SmartSpace responded to the offer with the following statement on the London Stock Exchange at 7am on Wednesday: “The board of SmartSpace is considering Skedda’s proposal with its advisers and the company is continuing to consult with its major shareholders.” Its share price has risen further to 71.50p.