Patch, an EnviroTech company which aims to make meaningful climate action a part of every business, has raised £48 million in Series B funding.

Scientific consensus from the UN IPCC shows that reaching global climate goals will require carbon removal to scale 1 million times current capacity by 2050.

Patch, jointly headquartered in London and San Francisco, plays an essential role at the intersection of climate and technology by powering the ability to embed, through an enterprise grade API, climate action into every product and service – a critical component to achieving this level of scale.

The platform enables businesses of any size, with any budget, to easily purchase carbon credits. It says its transparent infrastructure is transforming a traditionally complex and opaque system.

Energize Ventures led the round with participation from new and existing investors including Coatue Management and Andreessen Horowitz, bringing the company to a total of $80m in funding to date.

“We are at a crucial pivot point, and it’s essential we get as many companies as possible taking action to reverse climate change, but many struggle with how to integrate this action into their business,” said Brennan Spellacy, CEO and co-founder.

“At Patch, we are changing that. Our infrastructure lowers the barrier to entry for both businesses and climate project developers looking to enter the carbon market which, in turn, could help unlock 20% of the climate change solution the world so desperately needs.”

https://businesscloud.co.uk/envirotech-50-uks-most-innovative-green-technology-creators-for-2022/

Patch has grown its team by 400% to more than 60 employees worldwide in the last 12 months and opened a European headquarters in London. It has also grown its customer base five times to more than 100 companies worldwide.

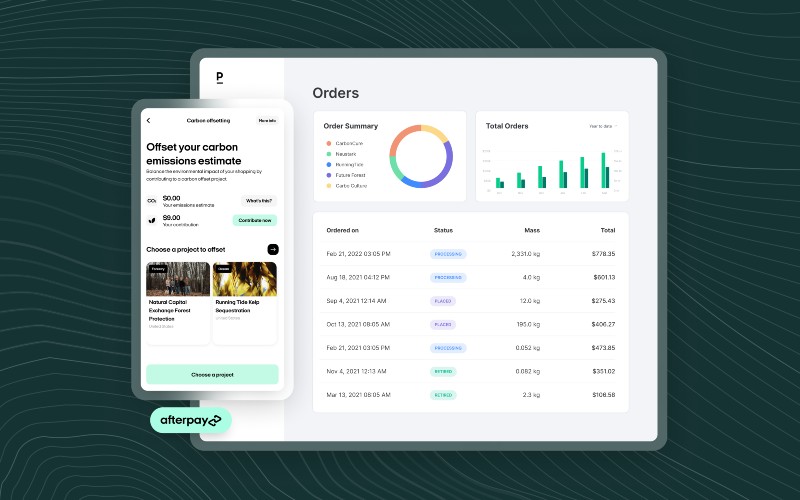

Clients include Afterpay, the Buy Now Pay Later group, which says thousands of its customers can now both understand and take action to neutralise the emissions associated with their purchases.

European investor EQT, meanwhile, has leveraged Patch to position itself at the forefront of climate innovation. It uses the platform to neutralise its own carbon footprint through investments in frontier technologies.

“The market for carbon credits is on a trajectory to reach $50 billion in the next 10 years, making it one of the largest and most paramount markets of our time,” said Energize Ventures partner Tyler Lancaster, who joins the Patch board of directors.

“However, today’s carbon credit infrastructure is highly fragmented and lacks standardisation – making it difficult and complex to tap into.

“Patch’s platform provides a much-needed digital backbone that simplifies the transaction complexity of the carbon management ecosystem for both buyers and suppliers, increases transparency, and enables the carbon market to scale to meet global climate goals.”