A Net Zero pensions FinTech has raised £35 million in fresh funding and acquired pensions trust Creative.

Poole-headquartered Cushon said the deal, which is subject to FCA approval, sees it become the UK’s fifth-largest pensions provider with more than 400,000 members.

It brings Cushon’s total assets under management – including ISA savings – to over £1.7 billion with annual inflows of circa £300 million.

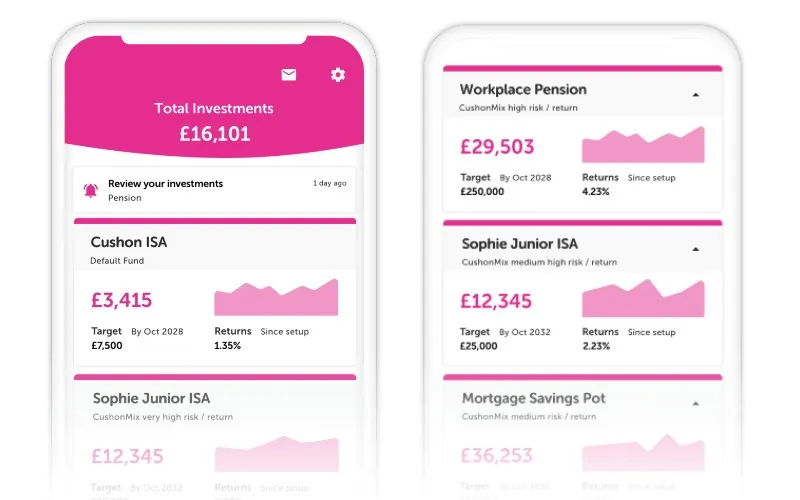

It will use the funding – which comes from existing investors and takes total investment since 2020 to £61m – to further develop its app and automated investment monitoring service CushonMe.

Environmental impact of UK pensions market

The UK pensions market is the third largest in the world – with a total of £2.58 trillion invested – and the way people’s money is invested has a significant impact on society and the environment. The average UK pension finances a staggering 23 tonnes in CO2e every year, roughly equivalent to five family cars.

Cushon aims to have a positive impact on society by making saving and investing through the workplace more convenient, better value for money, and with a clearer connection to the impact people’s money is having on the world.

“Our mission is to offer UK savers a convenient, climate-friendly, and great value way to save, through a combination of cutting-edge technology and socially responsible investments,” said Ben Pollard, CEO and founder.

“Right now, workplace pensions are simply too complicated, boring, and disconnected from things people care deeply about. Cushon is here to change that, and today’s announcement is a hugely significant milestone for us. The funding will continue to fuel Cushon’s growth, enable us to scale even faster, and accelerate some exciting new features within our app.

“It will also support the acquisition of Creative which not only doubles the reach of our app-first climate-friendly pension, but also incorporates the talent, expertise and credibility of the Creative business.

“This is another momentous step on our journey to ensure millions of people across the UK have the ability to access innovative workplace savings solutions in the palm of their hand, together with a right to feel optimistic for the future they are helping to build via their investments.”

Sally Webber, CEO at Creative, said: “With more and more customers looking to use technology to manage their pension, and a heightened focus on the environmental and social impact of investments, joining the Cushon group will allow us to ensure our customers’ interests are both considered and protected.

“Our employers and customers alike will benefit from Cushon’s wider workplace savings offering and its innovative, technology-led approach – unlike any other workplace savings provider in the market.

“We are excited to become a part of the Cushon Group, enhancing the offering for both our employers and customers.”