London-headquartered Rezolve is to list on the NASDAQ via a $2 billion SPAC deal.

The mobile engagement platform has reached an agreement to merge with Cohen & Company-backed Armada Acquisition Corp, a specially created company listed on the New York exchange.

The transaction is expected to result in $190 million in gross proceeds, including $150m in trust and approximately $40m of additional capital from Christian Angermayer and Betsy Cohen.

“Rezolve sits at the intersection of eCommerce enablement, digital payments and eMarketing technology,” said Cohen.

“They have developed proprietary technology with a powerful partner driven business model that could lead to rapid growth in the still nascent but potentially massive mobile commerce market.”

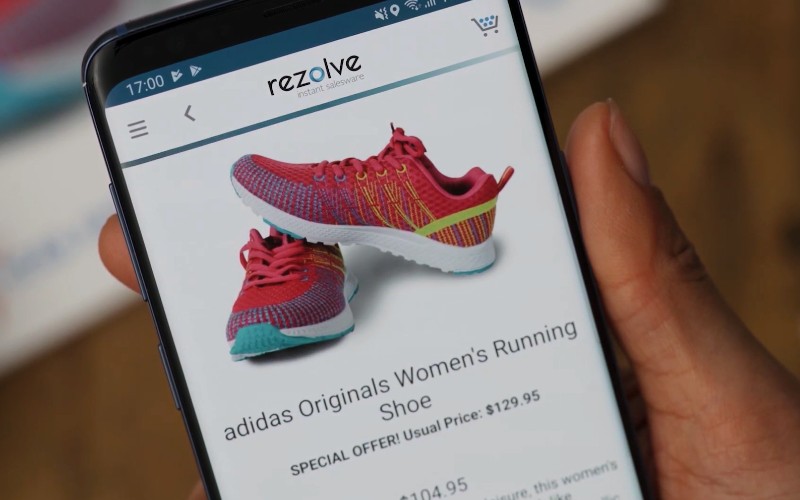

Rezolve says it is positioned to become the engine of mobile engagement that enables the transformation of interactions between consumers and merchants on mobile devices.

An enterprise SaaS platform designed from the ground up specifically for mobile commerce and engagement, it allows merchants and brands to convert media into an interactive experience on a mobile device, which can drive a meaningful increase in consumer engagement and purchase activity.

Rezolve currently has go-to-market partner agreements with leading global players that have a combined global reach of over 20 million merchants and over 1 billion consumers across China, Asia and Europe. The platform already serves over 150,000 of those merchants today.

Rezolve founder and CEO Dan Wagner has been building eCommerce businesses for over 35 years and will continue to lead the combined company following the close of the transaction.

“I believe that Rezolve has the potential to eventually become one of the most successful eCommerce companies in the world. That’s why I have been investing in Rezolve from the early rounds and why I am stepping up my investment in Rezolve in this transaction now,” added Angermayer, the founder of investment firm Apeiron Investment Group.

“I deeply believe that this is just the beginning of something very big.”

Armada chairman and CEO Stephen Herbert added: “Douglas Lurio and I set out to find a company that had carved out a unique position in the FinTech sector, with a recurring revenue model at an inflection point where our additional capital and expertise could drive rapid accelerating growth.

“We believe that we have found that with Rezolve. We believe that Rezolve is a potential market leader and that our valuation of Rezolve is priced at a significant discount to our selected publicly traded peers.”