The board of life science software firm Instem plc has accepted a £203 million takeover approach.

The offer from Ichor Management Limited – a newly incorporated company controlled by funds managed by ARCHIMED SAS – values the Stone-headquartered company at 833 pence per share, a 41% premium to the closing price of 590p on Tuesday.

It values the company at £203m, £68m higher than its present market cap.

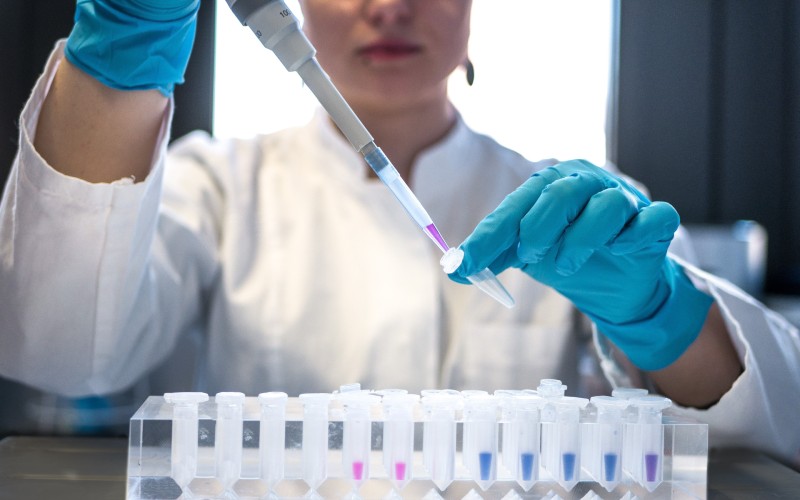

Instem is a provider of workflow, data and IT solutions across the drug development lifecycle to the global life sciences market.

Floated in 2010 with a share price of 204p at admission, it reached a high of just below 900p late last year.

With offices in Europe, North America and Asia, ARCHIMED is a global investment firm that is exclusively focused on healthcare industries, with more than €8 billion of assets under management and past and current investments in 32 healthcare companies that serve customers around the world.

Ichor says Instem can leverage ARCHIMED’s deep industry knowledge and network as a healthcare specialist investor to accelerate its growth strategy and support the transition of customers from on-premise solutions to the cloud.

It also intends to deploy capital to finance further M&A opportunities.

Unleashing technology’s potential for the autistic community

“The Instem board is pleased with the considerable progress made by the company following the successful integration of acquisitions and the implementation of its strategy to achieve and maintain a growing portfolio of ‘world leading life science workflow and data solutions’,” said David Gare, chair of Instem.

“While this strategy, endorsed by the board, is anticipated to generate substantial long-term value for shareholders, we also note that the next phase of development for the business is at an early stage and there is an element of risk attached to some of our recent initiatives, which will take time to deliver value.

“The offer… represents an attractive valuation and offers shareholders the certainty of cash today, while also fairly reflecting the exceptional quality of the Instem business, its people and its future prospects.

“Under private ownership, without the costs and regulation of a listed company, Instem will be able to pursue its organic growth strategy, while benefiting from the expertise and capital to accelerate its successful acquisitive growth plan.”

Instem shareholders will now vote on the proposed deal.