Capital on Tap has secured a funding facility of more than £150 million with HSBC and Värde Partners to support its continued US growth.

The London FinTech launched in 2012 and has provided over £3.5 billion of funding to more than 125,000 small and medium-sized businesses across the UK and US.

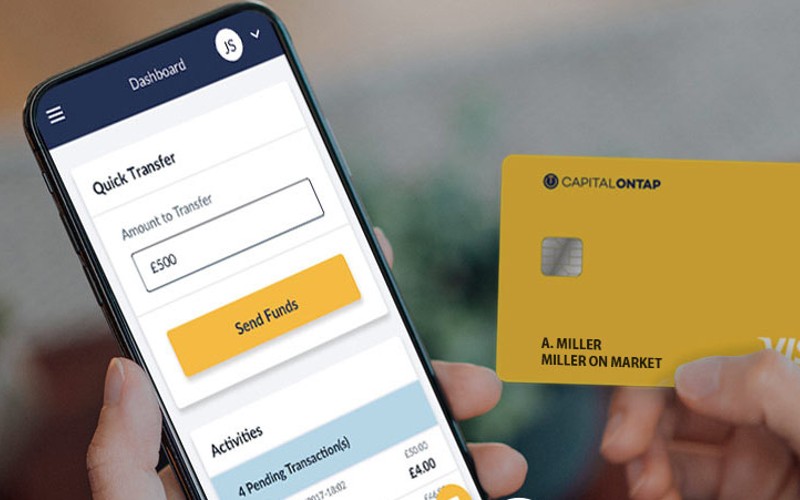

One of the UK’s fastest-growing businesses, it provides business credit cards with employee spending controls, reporting and rewards.

Capital on Tap made Atlanta its American home when it launched its US credit card in March 2021, helping small and medium-sized businesses recover following the pandemic’s harsh economic downturn. With 50 employees in Atlanta and active recruitment ongoing for more, Capital on Tap is ready to provide leadership and opportunity for Atlanta’s tech community.

“With the closing of this facility we are looking forward to expanding our ability to provide essential funding for small businesses across the United States,” said Alan Hart, CFO.

“We are thrilled to be joined in this mission with Värde Partners as well as extending our already international relationship with HSBC.”

Aneek Mamik, partner and global co-head of financial services, Värde Partners, said: “We are pleased to establish a partnership with Capital on Tap as they continue successfully expanding by providing faster and simpler working capital and payments tools to empower business owners.

“We see this as a good example of an emerging substantial investable opportunity set for us, providing capital solutions to digitally oriented non-bank lenders that are financing the needs of businesses investing in their products and customers.”