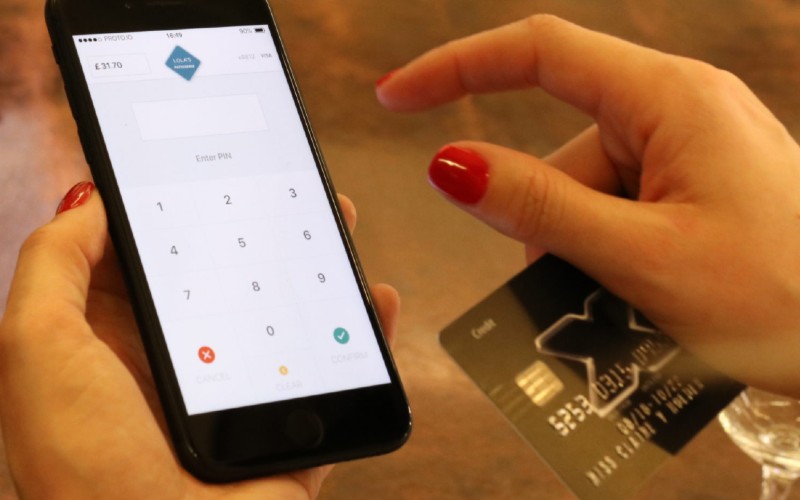

Mypinpad, an innovator in mobile card payments acceptance and identity authentication software solutions, has raised more than £10 million in funding.

Crossfin Holdings has backed the Cardiff FinTech with strategic investment to assist its expansion and support Mypinpad’s goal of building out its global payments and authentication SaaS offerings.

Crossfin is a leading independent FinTech group with a portfolio of innovative emerging market companies that focus on solving specific everyday pain points that are not adequately covered by existing products in the market.

Mypinpad will further benefit from partnerships with other companies within Crossfin’s portfolio, many of which are engaged in areas closely associated with Mypinpad’s activities.

“We are incredibly proud to have secured this investment, especially in the current difficult investment climate,” said Barry Levett, CEO of Mypinpad. “It demonstrates market recognition of our value proposition, successful track record and the innovative solutions we offer.

“This investment will provide the necessary fuel to accelerate our growth, strengthen our global reach and potentially expand into new verticals.”

Dean Sparrow, CEO and co-founder at Crossfin, says the investment unlocks exciting synergies with the broader Crossfin portfolio.

“Barry and his team have built an innovative, scalable business that aligns well with Crossfin’s best-of-breed mPOS and SoftPOS payment solutions and related mobile payment security solutions, enabling us to extend our reach across emerging markets globally.”

Currently with clients in over 20 different countries, in APAC, EMEA and the Americas, the funds secured will be utilised to further develop Mypinpad’s suite of mobile payments acceptance and authentication solutions, drive technological advancements and expand into new market segments.