Honcho is the Durham-based fintech innovator that are on a mission to transform the world of insurance distribution.

For years, consumers have been conditioned by the insurance aggregation market into purely and solely focusing on price when buying insurance. Whilst no-one wants to pay too much for anything, when it comes to insurance cheap is not necessarily good as consumers are at risk of choosing insurance that lacks the level of cover that they require in order to get the cheapest deals.

Honcho takes a very different approach to insurance buying, focussing on helping consumers to discover the insurance protection that is right for them, and then to get that at the best possible price via their unique reverse auction marketplace.

Disrupting insurance distribution

Across the global fintech landscape, few innovators are focussing specifically on insurance distribution. Honcho are on a mission to redefine how insurers, brokers and MGAs distribute their products, creating an alternative to the old fashioned price comparison website model that for so long has focussed solely price and which has ultimately delivered a poor experience for both insurance providers and consumers.

Reverse auction marketplace

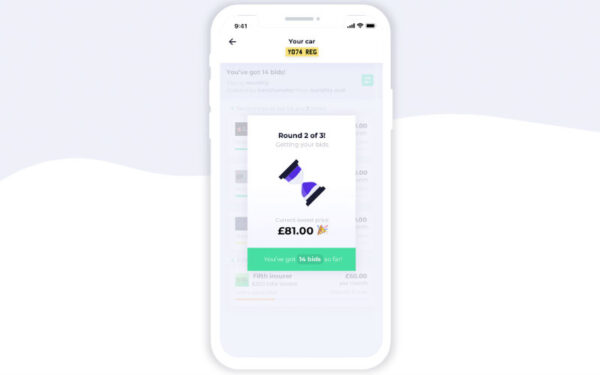

Honcho is the world’s first reverse auction marketplace for financial services. Every market has consumers with specific requirements and many providers who can meet those needs. Honcho brings buyers and sellers of insurance together to help consumers to specify the exact product features that they need, and insurance providers to compete against each other in real time to try to win the business that makes sense to them.

The Honcho apps – iOS, Android and web – help consumers to identify their requirements for car or van insurance, and then Honcho broadcast this out to their marketplace of providers. Over a 30 second period insurance providers have 3 opportunities to price and re-price (downwards only) to try to win that business with the knowledge of how everyone else in the market is pricing that risk. It is totally unique.

Honcho has a fundamental commercial difference too. Unlike aggregators’ outdated commission model, Honcho charges providers just £1 to bid for consumers’ business. And that’s it.

Traction

Launched in autumn 2019 into the UK private car market and with van launched a year later, Honcho has great traction from their first year of trading and dozens of insurance providers integrated to their platform.

With £3.8m in capital funding raised from 1,800 crowd investors plus VCs Maven Capital Partners and Insurtech Gateway, Honcho are one to watch closely.

Find out more at gethoncho.com.