The balancing act of being a student is tough enough without having to worry about money. But, as any parent or guardian will tell you, financial stress can seriously impact academic success and overall well-being.

Thankfully, there are some ways that students can improve their financial situation without compromising their studies. Here are some tips and tricks to help you stretch your budget further and ease the financial burden. Implementing even just a few of these strategies can make a big difference in your bottom line – and your peace of mind!

Get a part-time job

Managing your finances as a student can be difficult, especially if you don’t have any financial support from family. However, there are strategies that you can use to improve your finances without compromising on your academic success or overall well-being.

One of the best ways to achieve this is by getting yourself a part-time job. With some extra money coming in, it’ll make it easier for you to pay off loans and other bills without taking out additional debt.

Furthermore, gaining work experience can help build your skillset while allowing you to make money at the same time. If you still find it difficult to find a job after using these tips, consider how to take out a loan and how it could help you manage your expenses.

Make a budget and stick to it

Making and sticking to a budget is essential to taking control of your finances. Creating a budget can help you identify where your money is going each month and allows you to focus on your long-term financial goals.

Furthermore, tracking your expenses over time can help you pinpoint ways to save money and be more mindful about how you spend your money. It’s important to remember that a budget won’t magically make all of your financial problems disappear overnight; it will take discipline and dedication to stick to it in order for it to be effective.

But with the right plan in place, you can work towards better managing and improving your financial situation without compromising either your academics or overall health.

Cut down on unnecessary expenses

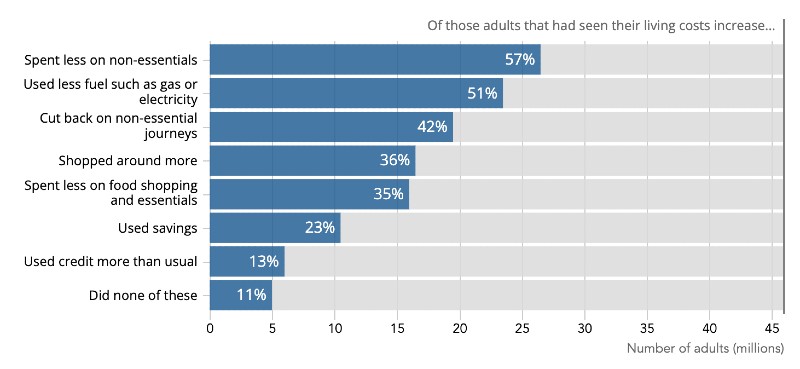

Cutting down on unnecessary expenses is an effective way to manage your finances while in school. A staggering majority of individuals who have experienced a rise in their cost of living, an impressive 6 out 10 to be precise, have slashed their expenses on non-necessities.

To start, determine what your needs, wants, and desires are and create a budget that factors these in. For instance, if you need transportation to get to class, consider taking public transit or sharing rides with friends instead of buying a car. For wants and desires—like eating out or going out with friends—be mindful about how often you’re indulging.

Put away some money for fun activities but remember that overspending can cause a budget blowout! Sticking within your limits will help you build better spending habits so that you’ll be prepared to handle life’s financial obstacles even after graduation.

Find scholarships and grants

Applying for scholarships and grants is one of the best ways for students to take control of their financial situation. With careful research and dedication, these opportunities can help offset some of the high costs associated with tuition, housing, books and other expenses.

It’s important to remember that all types of scholarships are out there, from academic achievements to unique circumstances like backgrounds or interests. Additionally, looking out for grants is beneficial as they are essentially free money that doesn’t need to be paid back, making them even more sought-after.

Many grants are also provided by government organizations and universities, so take the time to explore opportunities applicable to your needs, as many have specific criteria to qualify. Finally, don’t forget that there is no limit on how many scholarships or grants you can apply for; ultimately, any amount of money helps.

Live with roommates to save on rent and utilities

Roommates are a great way for college students to save on living expenses, as rent and utilities can make up most of your budget. Splitting the cost between multiple people can easily help reduce financial strain; however, choosing roommates wisely is important to ensure a positive living experience.

When selecting potential roommates, consider factors such as compatible study habits, attitudes towards cleanliness and visitors, and other personal interests. With careful consideration and conversation ahead of time, living with roommates can be an enjoyable experience that helps college students stay within their budgets while still attaining their academic goals.

Cook at home instead of eating out

Eating out can often be a tempting and delightful experience, but it is not conducive to saving money for students. Savings can easily be made by decreasing the frequency of eating out and reallocating that money for other expenses.

Students can save more by taking the time to learn how to cook at home and take advantage of the necessary tools, such as kitchen appliances and utensils, which will not only enhance their culinary skills but also reduce their spending over time.

Furthermore, cooking meals at home has additional health benefits since they can choose nutrient-dense ingredients to create balanced and wholesome meals. Overall, preparing meals at home instead of eating out is a desirable choice when it comes being financially responsible while still having delicious food.

Conclusion

All in all, improving your financial situation doesn’t have to be a hard process. With a few simple changes, you can make strides toward financial independence without compromising your lifestyle or academic success.

From finding part-time work and grant opportunities to cutting down on unnecessary expenses and living with roommates – there are numerous ways to save money while still attending school. Taking the time to create a budget and sticking to it is an important first step, but remember that it’s also okay to allow yourself small indulgences occasionally.

Above all else, use these strategies as guidelines and take control of your finances by doing what best suits you in the long-term. Your future self will thank you for it!