The bounce back scheme was meant to help businesses survive the pandemic. Companies could access loans of up to £50,000 entirely guaranteed by the UK government. Yet, £4.9bn of the £47bn loaned to 1.1m businesses between May 2020 and March 2021 were claimed by fraudsters!

How was this allowed to happen?

The scheme was created by the British Business Bank, which reports to the business department, doing only minimal checks on borrowers. Why? Officials were pressured to support companies as fast as possible.

“Lend in haste, repent at leisure,” said one government official during several hearings where MPs demanded answers from officials, bankers and regulators about how such large sums were allowed to be swindled with such ease

Will the government ever reclaim the lost billions?

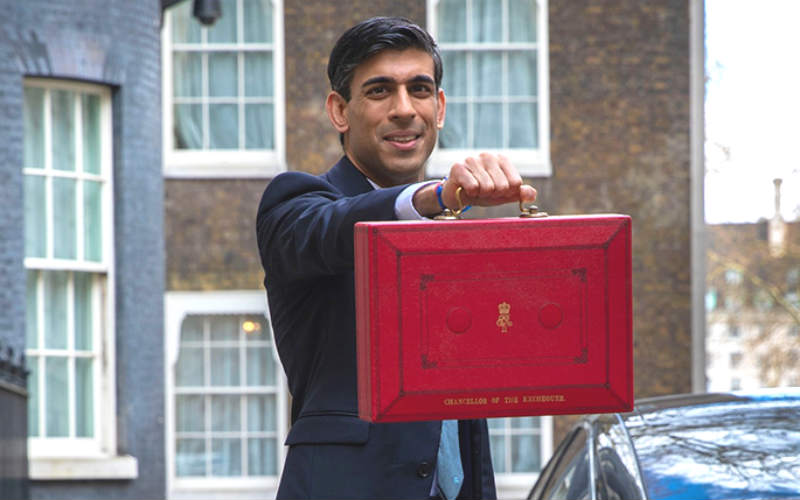

In late January this year, chancellor Rishi Sunak promised that the government was “going to do everything we can to get that money back and go after those who took advantage of the pandemic.”

Realistically, this is unlikely to occur. Experts caution that the magnitude of the fraud makes it problematic. “The volume of crimes is so high, the authorities don’t have capacity to investigate these,” said David Clarke, former head of the City of London Police Fraud Squad and counter-fraud expert.

Who made the fraudulent claims?

Most of the fraudulent claims are by individuals without limited companies, or by businesses who greatly exaggerated their revenues allowing them to get the largest possible loan amount of £50,000 from their banks.

Instead of these individuals being prosecuted by the courts, they are being forced to resign as company directors and are forbidden to take up new director positions. This makes it unlikely that these individuals will ever have to repay the sums they borrowed.

What is being done?

The focus has been on high-profile cases, think getting back money from organised criminals who have significant assets that can be taken.

The National Audit Office claims that the National Investigation Service (NIS), who guards the public sector from organised crime who were only able to pursue 50 cases annually. The business department expects that the NIS will get back only £6mm of fraudulent claims in the next 3 year. A tiny proportion of projected lost funds.

The shortage of fraud investigators and limited access to court rooms will result in most fraudsters avoiding justice.

Why is fraud largely ignored unless it’s considered top tier?

Even though hundreds are being drafted to fraud prevention teams, commercial incentives are a big blocker. The incentives to investigate lower and mid-tier fraud is tepid at best. Banks are simply able to reclaim these lost funds through the government guarantee.

The assured reimbursement of lost funds from smaller cases provides no motivation for banks to uncover this fraud. Once the government guarantee has been paid, banks are supposed to keep chasing fraud for a year.

How much have banks claimed back in guarantees?

Banks have received £70mn in guarantees from the government for unpaid loans, including personal, business and short term loans. However more than £240mm claims on guarantees had to be withdrawn by banks. This was due to blunders made by the banks allowing fraudulent claims to be made

Banking lenders contend the backlash they have faced. Claiming that the government must heed caution and not throw them under the bus. Lenders posit that MPs were desperate at the beginning of Covid and pleaded for the banks to help to save UK businesses. Lenders claim they knew there would be fraud but they were simply rallying to the call of the government.