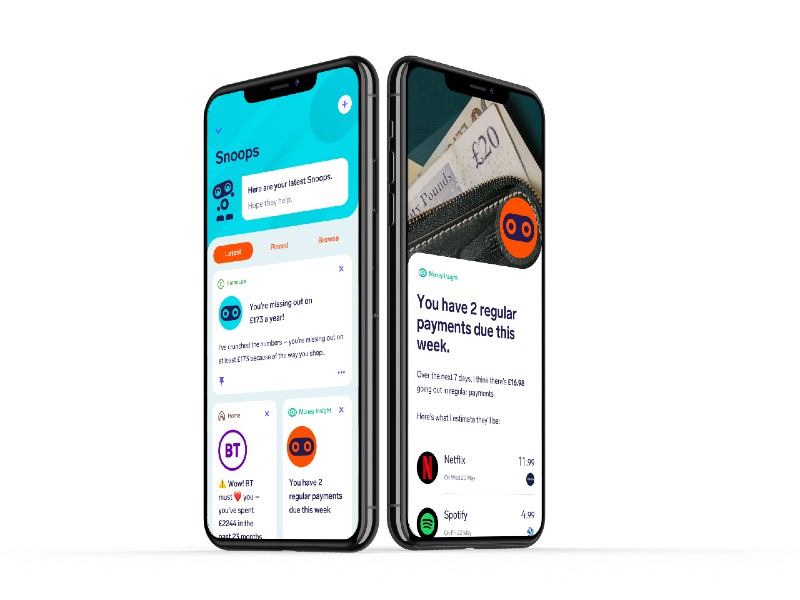

An ever-present in the FinTech 50 since 2020, Snoop is a data-driven, award-winning fintech designed to help customers save money, cut the cost of living, and make better financial decisions. Snoop leverages Open Banking and AI to deliver a personalised experience that targets annual savings of up to £1,500 per user. Eight out of ten users say it helps them manage their finances more easily and 93% would recommend it to others.

Making saving smarter: Easy Access Account + VRP

Snoop goes beyond traditional budgeting tools. In January 2025, the team launched the Snoop Easy Access Savings Account, a simple, flexible savings option with full FSCS protection and no minimum balance beyond £1. Managed seamlessly through the Snoop app, it’s designed to make saving effortless, whether you’re just getting started or building a financial cushion.

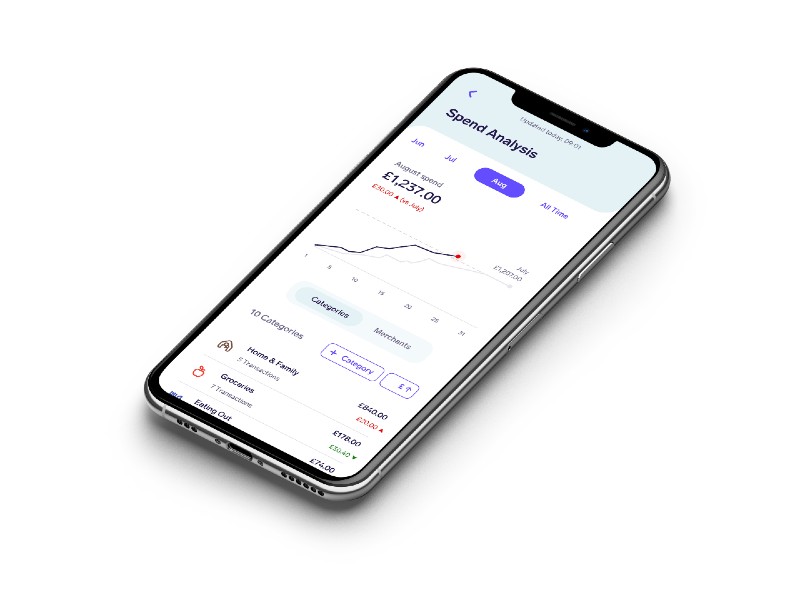

With Snoop’s innovative tools, users can:

• Track spending and watch their savings grow

• Get personalised nudges when they have spare cash to save

• Spot and manage low-return accounts easily

In May 2025, Snoop introduced Variable Recurring Payments (VRPs), a smarter way to automate saving. VRPs allow users to set flexible weekly or monthly transfers from their current account into their Snoop savings account, on whatever day suits them. No friction. No faff. Just smarter saving.

“This is about building better habits with less effort and helping people grow their money without needing to think about it every day.”

— John Natalizia, CEO & Co-founder, Snoop

With more than £280 billion sitting idle in UK bank accounts, Snoop is helping people move their money to where it works harder.

Transforming Money Management

Snoop is reshaping how people understand and interact with their finances. As the first UK app to weave credit score monitoring into a full money-management experience, it brings together the tools users need to make smarter decisions day-to-day and over the long term. From tracking spending and identifying savings opportunities to understanding how credit behaviour affects future financial options, Snoop provides a clear, joined-up view of personal finances.

Its inclusive freemium model ensures that these insights are available to everyone, not just those who can pay, making financial wellness more achievable for all.

Unlocking consumer intelligence with SpendMapper

Snoop also empowers organisations through SpendMapper, its self-service business intelligence platform launched in 2023. Built on more than £200 billion of real-time spending data, SpendMapper gives instant, sector-wide visibility into consumer behaviour. Its intuitive dashboard helps businesses refine products, sharpen marketing strategies, and enhance customer experiences.

Today, major retailers, media companies, consulting businesses and analytics firms are leveraging the platform to make smarter, data-led decisions.

“Snoop’s strength lies in our ability to support people and businesses alike. We help individuals make smarter financial decisions, and with SpendMapper, we give organisations the clarity they need to innovate and grow.”

— John Natalizia, CEO & Co-founder, Snoop

Part of Vanquis Banking Group

In 2023, Snoop was acquired by Vanquis Banking Group, a leading specialist bank focused on financial inclusion. By combining Snoop’s technology with Vanquis’ deep experience supporting underserved customers, the business is focused on driving meaningful, positive change in financial wellbeing across the UK.