FinTech startup Lightyear has raised £6.2 million in fresh funding alongside the launch of its app as the company starts to onboard UK customers from its waiting list.

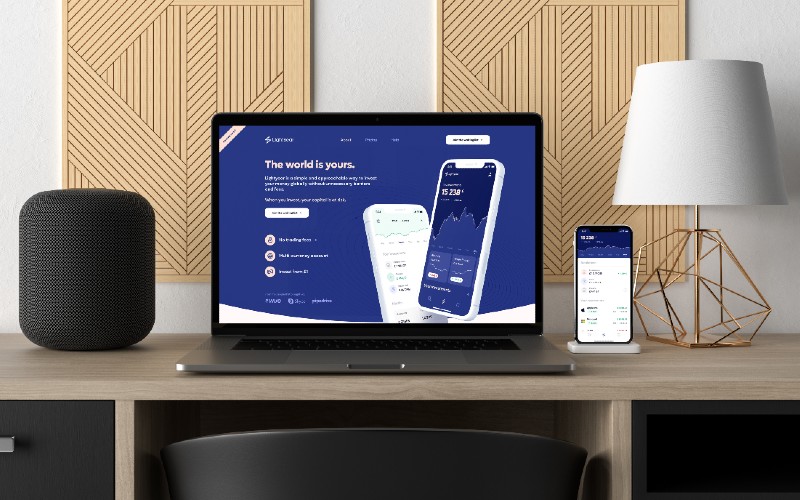

Lightyear says it combines multi-currency accounts with unlimited access to global markets so customers can invest freely without hidden fees.

Founded by early Wise alumni Martin Sokk and Mihkel Aamer, it pledges to bring a global mindset into the European investment space. Traditionally, if European investors wanted access to international markets they have been hit with a range of various fees such as transaction and custody fees, but most notably foreign exchange fees.

After removing the friction of sending money abroad during their time at Wise, the pair are looking to do the same with investing.

With unlimited access to more than 1,000 global stocks, Lightyear’s first iteration of the app – its minimum viable product – will start onboarding customers from the waitlist starting today.

Earlier this summer, Lightyear announced a £1m pre-seed round from a cohort of FinTech industry stalwarts, led by Taavet Hinrikus of Wise and Sten Tamkivi of Teleport and Jaan Tallinn of Skype.

The round also welcomed Ott Kaukver, the CTO at checkout.com, Wander Rutgers, the former president of Robinhood UK and Kaarel Kotkas, the founder of Veriff.

The latest funding is led by Mosaic Ventures alongside existing investors Taavet+Sten – the recently formed investment partnership of Taavet Hinrikus and Sten Tamkivi – and Metaplanet.

New angel investors coming in this time include early Monzo backer Eileen Burbidge, Harsh Sinha, the CTO at Wise and Taavi Tamkivi, the CEO at Salv.

“10 months ago Lightyear was just an idea, so we’re really excited to have raised a total of $10 million, hired a world-class team and to be launching the first iteration of our app,” said CEO Sokk.

“There are more people in Europe investing now than ever before, but there’s still a very long way to go. Our goal is to give all of Europe access to the world’s markets without hidden fees and to make investing cognitively easy.

“We’re excited to have such a strong group of investors that share this vision with us.”

Simon Levene, Mosaic co-founder and partner, said: “Compared to mature markets such as the US, retail investment across Europe is still at the beginning of its growth journey.

“The customer experience hasn’t really been cracked, and the majority of current offerings serve just their local country. Lightyear’s mission is to offer access to global markets for pan-European investors, providing all the necessary data and education they need – with a simple, transparent business model that removes all the hidden and confusing fee structures.

“We’re delighted to support co-founders Martin Sokk and Mihkel Aamer, two veteran execs from TransferWise, at the start of their journey to empower retail investors – experienced and new alike – across the continent.”

Burbidge added: “When it comes to investing in an early-stage business, it’s crucial that the team is best in class, that I believe in the sector, and the product has global appeal.

“We’ve seen more and more people interested in retail investing over the past year and a half, which, combined with this highly motivated, extremely talented and high integrity team, makes for something special.

“I’m excited by Lightyear’s commitment to transparency and building a platform that’s approachable and inclusive, where everyone has the best access, tools and confidence to invest.”